Stocks bottomed.

vrijdag 29 juli 2022

donderdag 28 juli 2022

woensdag 27 juli 2022

zaterdag 23 juli 2022

vrijdag 15 juli 2022

donderdag 14 juli 2022

Charles Nenner on Commodities

Nenner says commodities will go up in the coming year starting from November 2022.

woensdag 13 juli 2022

maandag 11 juli 2022

Natural Gas Situation in Europe

Natural gas flows to Europe are dangerously low.

LNG imports are at all time highs.

zaterdag 9 juli 2022

Temporary Workers Vs. S&P500

Temporary workers are a leading indicator for a recession as they are easy to be fired.

donderdag 7 juli 2022

woensdag 6 juli 2022

Yardeni decreases outlook for S&P500

Yardeni decreased the outlook for SP500 from 3315-4080 to 3290-3995 in 2022 and from 4125-4675 to 3825-4590 in 2023.

New:

Old:

dinsdag 5 juli 2022

vrijdag 1 juli 2022

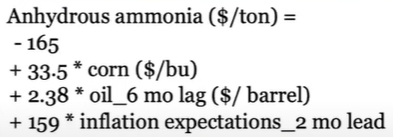

Gregg Ibendahl Ammonia Forecaster

The Gregg Ibendahl formula is a leading indicator for ammonia prices and can be used to accurately predict fertilizer prices.

Potash To Rise 50%

Potash is expected to rise further, possibly 50%.

The model also predicted potash prices could rise to $1,200/ton, while MAP prices could be in the $1,470/ton range, he said.

For some perspective, the highest average retail fertilizer price tracked by DTN for anhydrous this spring was $1,534/ton. For potash prices, the high point was set at $881/ton, while MAP peaked at $1,083/ton.