With oil trader positioning at lows, this is the time to get back into oil.

maandag 31 oktober 2022

Lula Won The Election: Bullish Verde Agritech

Lula is going to reform agriculture.

I believe this is bullish Verde Agritech:

- Interest reductions for farmers using biofertilizers

- Convert degraded pastures into farmland

- Lower diesel prices

- Ban Amazon potash

- Higher food prices

zondag 30 oktober 2022

Shale Gas Decline Rates Accelerating

This is why natural gas will go much higher. Shale gas production is flatlining due to high decline rates.

We have a history to look at.

Gas prices should rise, including AECO gas.

Oil wells have been becoming gassier. As oil demand drops, oil supply will need to be cut with it and that will have a significant impact on natural gas supply dropping.

Gas production will not rise that fast anymore.

zaterdag 29 oktober 2022

donderdag 27 oktober 2022

Citigroup Surprise Index Vs. Bond Yields

The Citigroup Surprise Index predicts bond yields.

Buy bonds (sell yields) when the citigroup surprise index is overly optimistic.

dinsdag 25 oktober 2022

Chinese Companies Delist

Here is the list of Chinese companies that face delisting next year.

Due to delisting risk, many Chinese companies crashed.

We see huge arbitrage in the U.S. listed shares, for example Daqo is trading at pe of 2 in the U.S., but at pe of 7 in Shanghai.

zondag 23 oktober 2022

vrijdag 21 oktober 2022

donderdag 20 oktober 2022

dinsdag 18 oktober 2022

Russia Railway Issues

Since Russia transports a lot of fertilizer, grain, energy via rail, this is going to impact production and increase prices.

donderdag 13 oktober 2022

woensdag 12 oktober 2022

dinsdag 11 oktober 2022

zaterdag 8 oktober 2022

Net liquidity Vs. Fed Assets/TGA/Reverse Repo

Net liquidity is now controlling the stock market via the following formula:

Net liquidity = Fed Assets - Treasury General Account - Reverse Repo

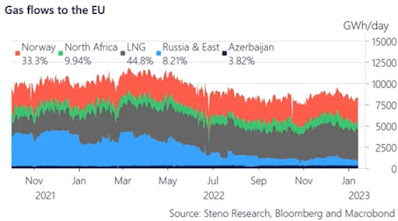

Natural Gas Flow To Europe Drops

Gas flows have been reduced due to Russian supply cuts. Europe has not been able to increase gas flows from other sources.

Russian gas exports won't recover.

LNG is expected to stay above $30/mcf until 2025.

Because the demand in EU + UK is so high that LNG imports are maxed out.

.png)

.png)

.png)

.png)

.png)