With oil trader positioning at lows, this is the time to get back into oil.

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

maandag 31 oktober 2022

Lula Won The Election: Bullish Verde Agritech

Lula is going to reform agriculture.

I believe this is bullish Verde Agritech:

- Interest reductions for farmers using biofertilizers

- Convert degraded pastures into farmland

- Lower diesel prices

- Ban Amazon potash

- Higher food prices

zondag 30 oktober 2022

Shale Gas Decline Rates Accelerating

This is why natural gas will go much higher. Shale gas production is flatlining due to high decline rates.

zaterdag 29 oktober 2022

Russia Potash Production is Cratering

donderdag 27 oktober 2022

Citigroup Surprise Index Vs. Bond Yields

The Citigroup Surprise Index predicts bond yields.

Buy bonds (sell yields) when the citigroup surprise index is overly optimistic.

dinsdag 25 oktober 2022

Chinese Companies Delist

zondag 23 oktober 2022

vrijdag 21 oktober 2022

donderdag 20 oktober 2022

Goods Spending Vs. Unemployment

When goods spending falls, the unemployment rate rises.

dinsdag 18 oktober 2022

Russia Railway Issues

Since Russia transports a lot of fertilizer, grain, energy via rail, this is going to impact production and increase prices.

donderdag 13 oktober 2022

woensdag 12 oktober 2022

dinsdag 11 oktober 2022

zaterdag 8 oktober 2022

Net liquidity Vs. Fed Assets/TGA/Reverse Repo

Net liquidity is now controlling the stock market via the following formula:

Net liquidity = Fed Assets - Treasury General Account - Reverse Repo

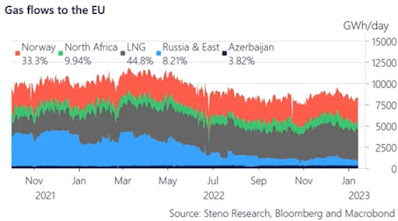

Natural Gas Flow To Europe Drops

Gas flows have been reduced due to Russian supply cuts. Europe has not been able to increase gas flows from other sources.

.png)

.png)

.png)

.png)

.png)