Happy New Year To All Readers!

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

dinsdag 31 december 2013

Demand for Silver Going up in China

If you have read this post, you will know that the Shanghai premiums to London gold prices are a proxy for higher demand for gold in China. Because when the premium shoots up, the demand in Shanghai shoots up too. Compare the two charts yourself.

Now, we can also do the same for silver. Look at the silver premium chart between Shanghai and London below. I do not even need to know how much the Chinese demand is for silver, because the silver premiums speak for themselves. We call this "the power of deduction".

And these peaks in silver premiums magically coincide with a drainage in the SLV trust. Let's see what happens next, will SLV be drained too in the same manner as GLD?

|

| (Courtesy of Koos Jansen, In Gold We Trust, original post) |

Now, we can also do the same for silver. Look at the silver premium chart between Shanghai and London below. I do not even need to know how much the Chinese demand is for silver, because the silver premiums speak for themselves. We call this "the power of deduction".

And these peaks in silver premiums magically coincide with a drainage in the SLV trust. Let's see what happens next, will SLV be drained too in the same manner as GLD?

maandag 30 december 2013

Comparing the China Gold Imports from Hong Kong Vs. Shanghai Delivery SGE

Let's compare the two charts. The first one is the amount of gold withdrawals from Shanghai gold exchange, which can be accessed here. The SGE withdrawal numbers in chart 1 is equal to Chinese imports and Chinese mine supply and is equal to Chinese demand for gold because all the gold is sold through the SGE. Note that January and December are the best months, because the Chinese have New Year in February. Note that in 2014, the SGEI was launched, so a new calculation needs to be implemented. For more info go here.

|

| Chart 1: SGE deliveries (original post) (Courtesy of Koos Janse, In Gold We Trust) |

|

| Chart 2: China Net Imports from Hong Kong |

Now let's put them together. What do you see?

|

| Chart 3: Chart 1 + Chart 2 |

First of all, the amount of gold withdrawn from the SGE is always higher than the net imports from Hong Kong to China. Chart 1 x 4 > Chart 2. That's because SGE covers imports and Chinese mine supply.

Second, both charts go up in time, which means Chinese increasing demand is real. You can even predict what the Chinese gold imports from Hong Kong will be, just by looking at the weekly numbers from SGE.

Third, the SGE numbers are approaching world mine supply (yellow blocks), which means the Chinese are buying up all the gold that is produced in the world at this moment. The only way the Chinese can get a hold of this gold is by buying it from someone who is selling (aka The West).

Fourth, if you look at the imports as a ratio of SGE deliveries, the Chinese are importing more and more gold instead of producing it. A few years ago they only imported 10 tonnes a month on a SGE delivery of 60 tonnes a month. Now they are importing 100 tonnes a month on a SGE delivery of 160 tonnes a month. That's an increase from 15% to 60%.

Fifth, now we come to the real interesting part. If we shift the two charts 4 months from each other. Then we see a perfect correlation. It means that when the SGE deliveries go up (Chinese demand goes up), then China needs to import more gold a few months later (imports from Hong Kong go up). The lag is about 4 months. This means we have a leading indicator for China gold imports from Hong Kong. I'm not sure about this correlation yet, we'll see when we get more data in the following year. But it looks promising. That also means you should follow the SGE gold deliveries rather than following the China gold imports from Hong Kong. (Edit: correlation confirmed by Koos Jansen)

|

| Chart 4: Chart 1 + Chart 2 Shifted 4 Months |

Sixth, now it becomes even more interesting. Whenever the volume of delivered gold at the SGE goes up, the premium between Shanghai and London goes up. See Chart 5 peaks in June and December which coincide with the peaks from Chart 1. This also means that you can monitor daily the premiums on Shanghai and then predict the weekly delivered gold at the SGE.

|

| Chart 5: Gold Premium Shanghai/London |

Let's recapitulate: In December, we see the gold premiums spike to 1.5%, which means there is a lot of delivery at the SGE (flowing out of GLD), which means Chinese gold demand is going up and that means that 4 months later we will see higher gold imports from Hong Kong.

Marc Faber Recommends Vietnamese Stocks

Remember Marc Faber recommending Vietnam? To go further on the case for investing in Vietnamese stocks in 2014, I wanted to point out several things.

First off, the savings rate in Vietnam is extremely high. We have 28% domestic savings rates and that's always a sign of a great economy. You can't produce and invest without savings.

Second, the inflation rate has come down from 20% in the past to 6% now. This will be great going forward as the dong (Vietnamese currency) will be stable going forward.

To point to a correlation on this blog, we know that the currency valuation is correlated to the trade deficit of a country and indeed, when we look at the trade deficit in Vietnam, we can see that Vietnam recently went into a surplus. This also explains why the dong is so strong lately and why the inflation rate is coming down.

To read further, go here.

First off, the savings rate in Vietnam is extremely high. We have 28% domestic savings rates and that's always a sign of a great economy. You can't produce and invest without savings.

Second, the inflation rate has come down from 20% in the past to 6% now. This will be great going forward as the dong (Vietnamese currency) will be stable going forward.

|

| Chart 1: Vietnam CPI |

|

| Chart 2: Trade Deficit Vietnam |

China Gold Imports From Hong Kong Drop in November

According to the latest data here, November wasn't a good month for China gold imports.

Gross imports turned back to their average. Net imports declined a lot more. Although these numbers are lower than usual, they are still higher than what we saw in pre-2008. Let's see what December will bring.

Gross imports turned back to their average. Net imports declined a lot more. Although these numbers are lower than usual, they are still higher than what we saw in pre-2008. Let's see what December will bring.

Would you Rent or Buy a House?

There is a very simple metric to see if it's better to buy or rent a house.

Just look at the price to rent ratio.

As you can see, Canada has the highest price to rent ratio in this chart, so it is better to rent than to buy a house in Canada. You can also see that Japanese houses are very cheap, so you could buy a house there. The United States is located on the historical average. My country, Belgium is still very highly priced, so I'm not going to buy a house in Belgium soon. For more charts about Belgium, go here.

An additional aspect to look at is the unemployment rate. Countries with a rising unemployment rate typically have a declining housing price index.

Let's take a few examples: Italy, Netherlands and Spain. All of them have a declining housing price and all of them have a rising unemployment rate. So buying houses when the housing price is going down is not a good idea as the biggest chunk of your money is going into the price asset of your house. Loan rates, maintenance, inflation are all sideshows compared to the price of your house.

On a final note it is also interesting to look at the amount of building permits that have been issued, if the trend of building permits goes up, the housing prices will go up and vice versa. But that data is difficult to find.

More info here:

Just look at the price to rent ratio.

|

| Price to Rent Ratio |

An additional aspect to look at is the unemployment rate. Countries with a rising unemployment rate typically have a declining housing price index.

Let's take a few examples: Italy, Netherlands and Spain. All of them have a declining housing price and all of them have a rising unemployment rate. So buying houses when the housing price is going down is not a good idea as the biggest chunk of your money is going into the price asset of your house. Loan rates, maintenance, inflation are all sideshows compared to the price of your house.

|

| Housing Prices |

|

| Unemployment Rate |

More info here:

zaterdag 28 december 2013

Status on Bitcoin

Today, we have a good example of the importance of correlations. As I noted before in this post, the Bitcoin price is correlated to the amount of unique Bitcoin addresses.

If we look at the Bitcoin addresses, it has hit a new low today, since the bursting of the Bitcoin bubble, which I covered here.

The Bitcoin price on the other hand has not made that new low yet as it would mean that Bitcoin should be going under $500/Bitcoin. But according to our correlation, this is bound to happen soon.

Let's see if it happens.

And by the way. If you think Bitcoin is the best cryptocurrency in the world, then look at Mr. Ripple. A currency I have never heard before and it almost overtook the Bitcoin market capitalization in begin December. All of the people saying that alternative cryptocurrencies don't hurt Bitcoin's price are completely wrong.

|

| Amount of Unique Bitcoin Addresses |

|

| Bitcoin Price |

And by the way. If you think Bitcoin is the best cryptocurrency in the world, then look at Mr. Ripple. A currency I have never heard before and it almost overtook the Bitcoin market capitalization in begin December. All of the people saying that alternative cryptocurrencies don't hurt Bitcoin's price are completely wrong.

vrijdag 27 december 2013

Euro surges against U.S. Dollar and Japanese Yen

As I predicted here and here, both the U.S. dollar and the Japanese yen are underperforming the euro. This is mainly because the central bank balance sheets of the U.S. and Japan are inflating, while the balance sheet of the Eurozone is shrinking/flatlined.

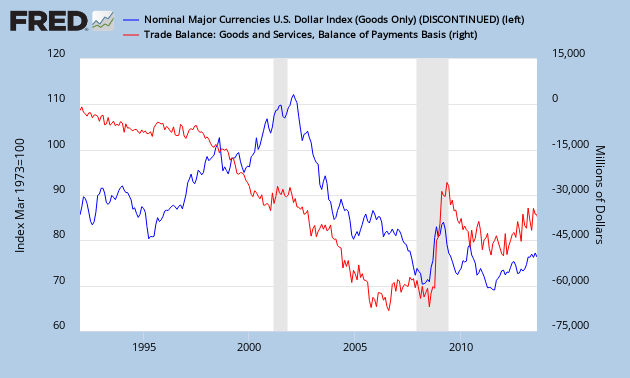

Moreover, we see that the Eurozone has a trade surplus while the U.S. and Japan have a trade deficit, which according to this correlation below, is good for the euro and bad for the U.S. dollar and Japanese yen.

At this moment, if all things stay equal, the euro will continue its rise against the U.S. dollar and Japanese yen. An extra catalyst following the asset-quality review (AQR) is that the European banks need to increase capital next year and they will need to buy euros for that.

This also means that U.S. and Japanese bonds will continue their decline as following correlation between currency and bond yields suggests.

You see, this is the power of correlations... Maybe I should rename this blog to: "Correlation Economics".

|

| Central Bank Balance Sheet Expansion is Bad for the Currency |

Moreover, we see that the Eurozone has a trade surplus while the U.S. and Japan have a trade deficit, which according to this correlation below, is good for the euro and bad for the U.S. dollar and Japanese yen.

|

| Deficit is correlated to Currency Valuation |

This also means that U.S. and Japanese bonds will continue their decline as following correlation between currency and bond yields suggests.

You see, this is the power of correlations... Maybe I should rename this blog to: "Correlation Economics".

Buy Emerging Market Stocks in 2014

One of the reasons I'm bullish on emerging market stocks is because they underperformed the U.S. in 2013. But most importantly, the P/E ratio of these emerging market stocks is at all time lows (P/E=11), while the P/E ratio in the U.S. is at 22. This is a valuation of more than double the emerging market stocks.

I think this underperformance in EM stocks is due to the underperformance of the CRB index as compared to U.S. stocks, which can also be seen here. Stocks went up (yellow line), but the CRB index (orange line) went down.

I believe the CRB index is now in a recovery phase. China's power consumption has been steadily increasing.

That's why I'm bullish on emerging market stocks. If you're not convinced yet, don't believe me, listen to Peter Schiff.

To read more, go here.

|

| PE ratio |

I think this underperformance in EM stocks is due to the underperformance of the CRB index as compared to U.S. stocks, which can also be seen here. Stocks went up (yellow line), but the CRB index (orange line) went down.

|

| Stocks Vs. CRB Index |

|

| China Power Consumption |

To read more, go here.

woensdag 25 december 2013

Mike Maloney predicts gold above $20000/ounce

It shocked me to see what the gold price could do in a few years, taking in account how much the Federal Reserve is printing today. This "tapering" talk is just a way to avert people from seeing the big picture.

A must see video:

Go ahead and subscribe for free to Mike Maloney's videos, there is a lot of stuff to watch there:

http://www.hiddensecretsofmoney.com/videos

dinsdag 24 december 2013

GDL ETF Outflows to Continue

Unlike some news sites and other blogs saying that Friday's 20 December GLD inflow for the first time in six weeks is surprising. I say it's just an anomaly in an ever decreasing GLD ETF.

Indeed, the GLD ETF added some tonnage on 20 December...

...just to lose it all immediately a business day later on 23 December.

The reason why I say this is that the gold price is much too low at this stage for the Chinese not to buy the physical gold.

Just look at the latest high premiums in Shanghai of 1.5%. So yes, the GLD ETF will continue to get drained unless the gold price goes much higher.

Indeed, the GLD ETF added some tonnage on 20 December...

| 19-Dec-13 | 808.72 |

| 20-Dec-13 | 814.12 |

| 23-Dec-13 | 805.72 |

...just to lose it all immediately a business day later on 23 December.

The reason why I say this is that the gold price is much too low at this stage for the Chinese not to buy the physical gold.

Just look at the latest high premiums in Shanghai of 1.5%. So yes, the GLD ETF will continue to get drained unless the gold price goes much higher.

Copper backwardation too steep

As predicted two months ago, the copper price has now moved up, because the contango went into backwardation.

I'm not too sure about what this massive backwardation in copper means, but as we saw copper go into backwardation these past weeks, the copper price hasn't really moved up as much as I expected. I'm more neutral now on the copper price. We also see that the large commercials have cut their long positions. We'll see where we go from here.

maandag 23 december 2013

Tax Revenue To Come Down, U.S. Dollar To Weaken Further

One of the main reasons why I think that tax revenues will not increase anymore is because the people don't have any savings left at this stage.

There is a correlation between what the government receives in taxes (blue chart), and the savings rate (red chart). When the savings rate makes a bottom, this coincides with a top in tax revenue.

There is a correlation between what the government receives in taxes (blue chart), and the savings rate (red chart). When the savings rate makes a bottom, this coincides with a top in tax revenue.

The savings rate just dropped to 4.2% from 4.5% and this will eliminate all hope that tax revenue will continue its increase. What this also means is that the deficit will likely continue to increase.

We already see this happening in the budget deficit, which has increased again (yellow chart). An increased deficit will weaken the U.S. dollar and put pressure on U.S. bonds (higher yields). With this information, you can prepare accordingly.

We already see this happening in the budget deficit, which has increased again (yellow chart). An increased deficit will weaken the U.S. dollar and put pressure on U.S. bonds (higher yields). With this information, you can prepare accordingly.

zaterdag 21 december 2013

GLD Will be Depleted in 5..4..3..2..1....

... June 2014.

Just a little request from someone to extrapolate the GLD ETF. I wonder if the gold price will hit zero next year.

(extrapolation based on the selling pressure after tapering)

And as an extra.

It has just gotten worse at the COMEX. Again a new low for registered gold as of today. We lost 12% of registered gold in just 1 day. At this rate, when we extrapolate again, the COMEX is defaulting before the end of the year. They can have all the eligible gold they want, but if there is no registered gold anymore, the game is over.

Leverage is skyrocketing exponentially and that's always, always the end of a bubble... In this case the gold suppression bubble.

vrijdag 20 december 2013

Stock Market Just Became Significantly Overvalued

According to the stock valuation chart, the stock market is now crossing the 115% ratio of total market cap against GNP. Which means we are crossing the border from modestly overvalued into significantly overvalued territory.

If global GDP weakens next year, a drop in the stock market will not be far off.

If global GDP weakens next year, a drop in the stock market will not be far off.

|

| Stock Valuation Table |

In fact, Marc Faber forecasts that the global economy will weaken next year.

And this is also confirmed by the declining GDP growth estimates.

| GDP Estimates |

Peter Schiff and Walmart

You've got to give Peter credit for this. Higher costs (labor costs or corporate taxes) in a business will always flow to the consumer. Because this is the only way a business can stay profitable. Of course, higher consumer prices are not sustainable, because the consumer won't buy your product. It's all supply and demand. Which means...

...the other way to stay in business is of course to just fire the employees. See this Salman Khan video:

Registered Gold Hits New Low at COMEX

You know what is very interesting? The registered gold at the COMEX hit a fresh new low. In just 1 day, the COMEX lost 20% of its total physical gold holdings.

We are now at a point that the COMEX could default instantly!

Eligible to registered gold leverage is now 15, a jump from 11 to 15, just in one day. You tell me if this is going to be sustainable.

If we look at open interest, we have 385432 or 38543200 ounces of gold against 490126 ounces of registered gold at the COMEX. That's a leverage of 38543200/490126 = 79. Up from 67 a month ago.

On the premium side we still see record silver premiums, both at APMEX and Shanghai:

Indeed, the GLD ETF is being raided again.

And by the way, the GLD outflows mean nothing, when the Chinese buy an ever increasing amount of gold at the same time.

woensdag 18 december 2013

Time for some music at Johnson and Johnson

Not macroeconomic news, but I'm pretty proud of this duo concert at JNJ, Beerse/Geel, Belgium, November, 2013.

dinsdag 17 december 2013

Total credit market debt Vs. Dow Jones

Total credit market debt growth is correlated with the Dow Jones. As everything in the economy requires loans, credit expansion drives the economy today.

Whenever this credit growth stops (blue line drops), the Dow Jones (red line) will go down with it. We have seen this in the 1987, 2000, 2008 crashes.

Monitor the blue line as it may be an important indicator.

Capacity utilization rate highest since 2008

When you take a look at the latest capacity utilization rate of November, you will see a surge. This means that inflation is indeed coming. Our correlation suggests this.

November posted a capacity utilization rate of 79%, the highest since 2008.

Make no illusion, the CPI will rise.

November posted a capacity utilization rate of 79%, the highest since 2008.

Make no illusion, the CPI will rise.

dinsdag 10 december 2013

Copper Turns to Backwardation

We finally went into backwardation in full force on copper the previous week, so I expect rising copper prices soon.

Copper miners are also bottoming out, take a look at Freeport-McMoRan and Capstone Mining.

Labels:

backwardation,

copper

Peter Schiff London Real Interview

If you haven't had enough, Peter talks about Bitcoin again.

zaterdag 7 december 2013

Labor Force Participation Rate Vs. Unemployment Rate

We all know the Unemployment Rate is rigged by the U.S. government. A much better indicator is the Labor Force Participation Rate. Historically, we see a negative correlation between the Labor Force Participation Rate and the Unemployment Rate.

Whenever the LFPR goes up (blue chart), we see a decline in the unemployment rate (red chart) and vice versa. This correlation has been true until 2008, where the U.S. government falsified the unemployment numbers and added hedonic adjustments. The red line should be going upwards since 2010 if we include discouraged workers, part-time workers, disabled workers, etc...

So, the key is to look at the labor force participation rate.

More info here. Labor force participation rate = green circle divided by yellow circle = amount of people who are working or seeking for work

So, the key is to look at the labor force participation rate.

More info here. Labor force participation rate = green circle divided by yellow circle = amount of people who are working or seeking for work

For more information, here is a chart with a longer time frame of the labor force participation rate for the working age population (25 - 54 years).

Labels:

correlation,

correlations,

force,

labor,

participation,

rate,

unemployment

How to Monitor the Labor Force Participation Rate

A Zerohedge article made me think about the unemployment rate. Apparently, year over year, the civilian population rose while the labor force declined. You might say: "What does this mean?".

Let's first look at this informative video from Salman Khan:

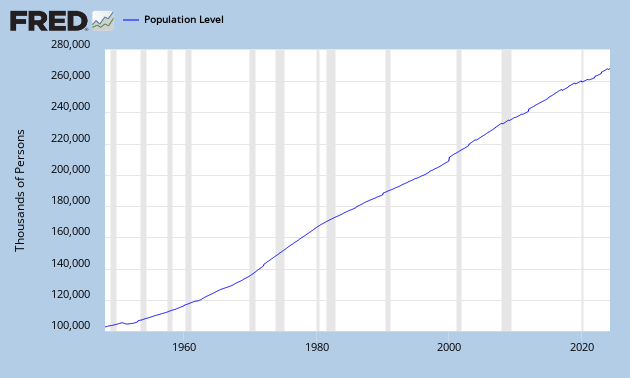

The yellow circle is the civilian population, people older than 16+ years, which can be found here:

Let's first look at this informative video from Salman Khan:

The yellow circle is the civilian population, people older than 16+ years, which can be found here:

The green circle is the labor force, people who can work (employed + unemployed), which can be found here:

This conveniently gives me the labor participation rate by dividing them: (labor force/civilian population):

You can see that since 2000, the labor force participation rate has been declining and it is even declining faster after 2008. When the labor force participation rate declines, it becomes more and more difficult to support the economy as a smaller amount of people are working for an increasing population. This will lead to higher deficits, higher taxes, less savings etc... So the labor force participation rate is a great economic indicator to watch.

If you look at the figure below, we see that the yellow circle is growing faster than the green circle. And just recently, the green circle is even declining. While the yellow circle is growing. The yellow circle can only grow if young people (younger than 16 years) come into that yellow circle.

This also means that people are going out of the labor force (green circle) at a faster rate than young people are getting into the population (yellow circle). This is probably due to people who are discouraged or going on retirement.

As the unemployment rate actually declined to 7% now, these people leaving the labor force are mostly unemployed.

It all sounds very difficult, just let it sink in...

Labels:

Academy,

force,

Khan,

labor,

participation,

population,

rate,

zerohedge

Abonneren op:

Reacties (Atom)