EU is going to have a bad winter as gas supplies are dwindling. LNG and coal are the only solution.

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

woensdag 29 juni 2022

maandag 27 juni 2022

SPR Vs. Oil Price

Whenever the U.S. strategic petroleum reserves get drawn down, oil goes down as supply hits the market.

zaterdag 25 juni 2022

Oil CAPEX Vs. Oil Prices

Oil CAPEX is at decade lows and should support higher oil prices.

Whenever CAPEX is low, prices will start rising.

vrijdag 24 juni 2022

Natural gas is cheapest energy

donderdag 23 juni 2022

Fertilizers trading below cost of production

zondag 19 juni 2022

Wealth between generations

Food production has not kept pace with food prices

zaterdag 18 juni 2022

vrijdag 17 juni 2022

donderdag 16 juni 2022

Natural gas will never drop

Natty will never drop. Anyone who thinks natty and food will drop again is dreaming.

woensdag 15 juni 2022

FOMC Meeting: Huge Rate Hikes

The Federal Reserve is planning to hike rates until 3.5% by the end of this year.

India Gold Imports Vs. India Agriculture Exports

dinsdag 14 juni 2022

Yardeni decreases outlook for SP500

Yardeni decreased the outlook for the S&P500 from 3825-4335 to 3315-4080 in 2022 and from 4400-4950 to 4125-4675 in 2023.

New:

maandag 13 juni 2022

Velocity is rising

Remember this formula. Money supply is up, velocity is up and goods produced are declining.

Guess what will happen with prices?

vrijdag 10 juni 2022

Annualized Return of Stocks/Currency Vs. Gold

Belangp created a nice corrrelation here.

What is the annualized return stocks vs gold today?

Germany Material Shortage

Warehouse Stock Level Inventories of Commodities

Railroad Surcharge Vs. Fertilizer Prices

When freight costs rise, the price of the good transported will rise with it. In this case fertilizers.

Annualized Return on Equity

A way to look at the annualized equity return is based on this formula: (equity+debt)/market value of equity. The black line shows the annualized stock return that investors earned over the subsequent 10 years.

donderdag 9 juni 2022

Farmland Vs. Fertilizer

As farmland goes up, more farmers will need to use fertilizer. Therefore, farmland is correlated to fertilizer.

woensdag 8 juni 2022

dinsdag 7 juni 2022

Affordability Fertilizer

vrijdag 3 juni 2022

woensdag 1 juni 2022

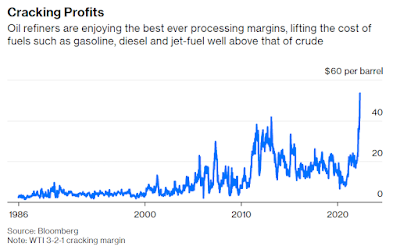

Refinery Margins

Refineries are making big bucks. This also means that crude oil should go higher as refineries will keep demanding for that crude oil.

Sprott Inc. Portfolio Update May 2022

Sprott Inc. filed their holdings.

Buys: Notable is Vale, Exxon, Steel Dynamics. Some gold mines: Kinross Gold, Sibanye, Newmont, Vizsla.

Sells: Vista gold, Mcewen, Kirkland, Gatos Silver and euro.