- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

vrijdag 27 maart 2020

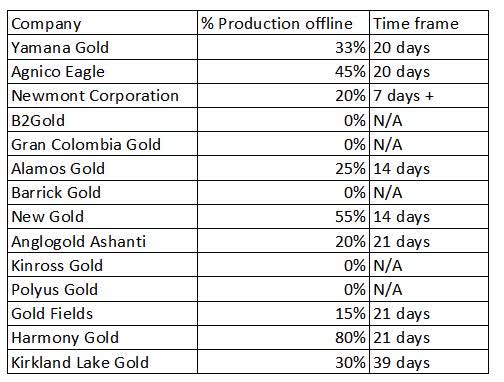

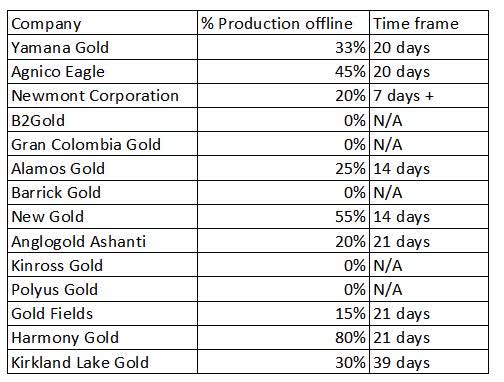

Gold Miners Shutting Down

Gold Miners all over the world are shutting down, this could disrupt supply of gold and should be beneficial to the gold price.

For more information, go here.

As for silver, Mexico (producing 23% of global silver), has also shut down mining for 1 month. I estimate that at least 75% of global silver supply is down based on the chart below.

For more information, go here.

As for silver, Mexico (producing 23% of global silver), has also shut down mining for 1 month. I estimate that at least 75% of global silver supply is down based on the chart below.

woensdag 25 maart 2020

When QE doesn't work anymore

As the economy is plunging.

The Fed is trying to pump up the market but isn't succeeding yet.

However, gold will catch up.

Because base money supply is going to skyrocket from $20 trillion to $30+ trillion. That's a 50% increase. So gold should also go up 50%.

maandag 23 maart 2020

zondag 22 maart 2020

donderdag 19 maart 2020

Silver Premiums skyrocketing

Investors finally wake up to the disconnect between paper and physical silver. A week ago you could for example buy the PSLV ETF at a discount and take delivery at a premium. That window has now almost closed as premiums are skyrocketing.

U.S. mint sales are booming in March 2020.

SLV stock level in the trust is rising, while the spot silver price is falling. This happened in 2008 as well and the next years, silver made a comeback.

On another note, the commercial silver shorts keep falling (-50% from the top) and open interest is declining to 166682 from 238970. This should be beneficial for the silver price.

Also silver premiums are rising.

U.S. mint sales are booming in March 2020.

SLV stock level in the trust is rising, while the spot silver price is falling. This happened in 2008 as well and the next years, silver made a comeback.

On another note, the commercial silver shorts keep falling (-50% from the top) and open interest is declining to 166682 from 238970. This should be beneficial for the silver price.

Also silver premiums are rising.

Keith Neumeyer says 25% of silver supply from mines is being shut down (Chile, Peru). This is a huge number.

VIX Vs. Margin Debt Gold Selling

One of the reasons why gold is declining together with the stock market is because of margin debt selling. To cover stock losses, investors needed to sell their gold and silver. The VIX shows when this margin selling occured in 2008. Today in 2020 we see a similar spike in the VIX and this might call the top in margin selling again. Each time this happened, easy money started to flow in from central banks and the gold price recovered sharply.

woensdag 18 maart 2020

dinsdag 17 maart 2020

Oil is going much lower

The equilibrium price of Brent oil is around $20/barrel. The only way to get oil back up is to get demand higher. Trump could buy up 3 billion barrels per day for example. This would quickly push up the price to $40/barrel.

Some say global oil demand is set to plunge by more than 10 percent from the typical 100-million-bpd consumption, as the raging coronavirus pandemic forces countries into lockdown. This is according to the world’s biggest independent oil trader, Vitol. This would push the oil price to $3/barrel.

On top of that, Trump is not going to bailout oil producers by increasing strategic oil reserves.

Update: China is now buying oil to prop up its oil reserves. This will push up oil prices.

Update 2: Trump is meeting with Saudi Arabia and Russia and we could see 10 million barrels production cuts.

Some say global oil demand is set to plunge by more than 10 percent from the typical 100-million-bpd consumption, as the raging coronavirus pandemic forces countries into lockdown. This is according to the world’s biggest independent oil trader, Vitol. This would push the oil price to $3/barrel.

On top of that, Trump is not going to bailout oil producers by increasing strategic oil reserves.

Update: China is now buying oil to prop up its oil reserves. This will push up oil prices.

Update 2: Trump is meeting with Saudi Arabia and Russia and we could see 10 million barrels production cuts.

China Power Consumption Falls 7.8% YoY

China power consumption is cratering 7.8% yoy and GDP will fall as well. It was so bad they didn't even give exact numbers, so I had to guess.

Labels:

China,

consumption,

power

zondag 15 maart 2020

Debt Defaults

Labels:

comparison,

countries,

country,

Debt,

gdp

zaterdag 14 maart 2020

Silver premiums are moving higher

The recent smash on gold and silver were probably attributed to liquidity selling to pay off debt, because there was not enough collateral left on the balance sheets. So companies were forced to sell out gold and silver.

But investors know that gold and silver are a very good buy around this level as dealers cannot source their gold and silver anymore. We are seeing delays in shipment and higher premiums, especially on junk silver. Premiums went to a high of 70% on silver coins and junk silver. People like Pierre Lassonde are accumulating cheap gold mining stocks like Alamos Gold.

But investors know that gold and silver are a very good buy around this level as dealers cannot source their gold and silver anymore. We are seeing delays in shipment and higher premiums, especially on junk silver. Premiums went to a high of 70% on silver coins and junk silver. People like Pierre Lassonde are accumulating cheap gold mining stocks like Alamos Gold.

Abonneren op:

Reacties (Atom)