Vehicles need autocatalysts like rhodium/palladium/platinum. China is increasingly using more of these PGM's in their vehicles.

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

zaterdag 30 januari 2021

Vehicle Sales Vs. Autocatalyst Demand (Platinum/Palladium/Rhodium)

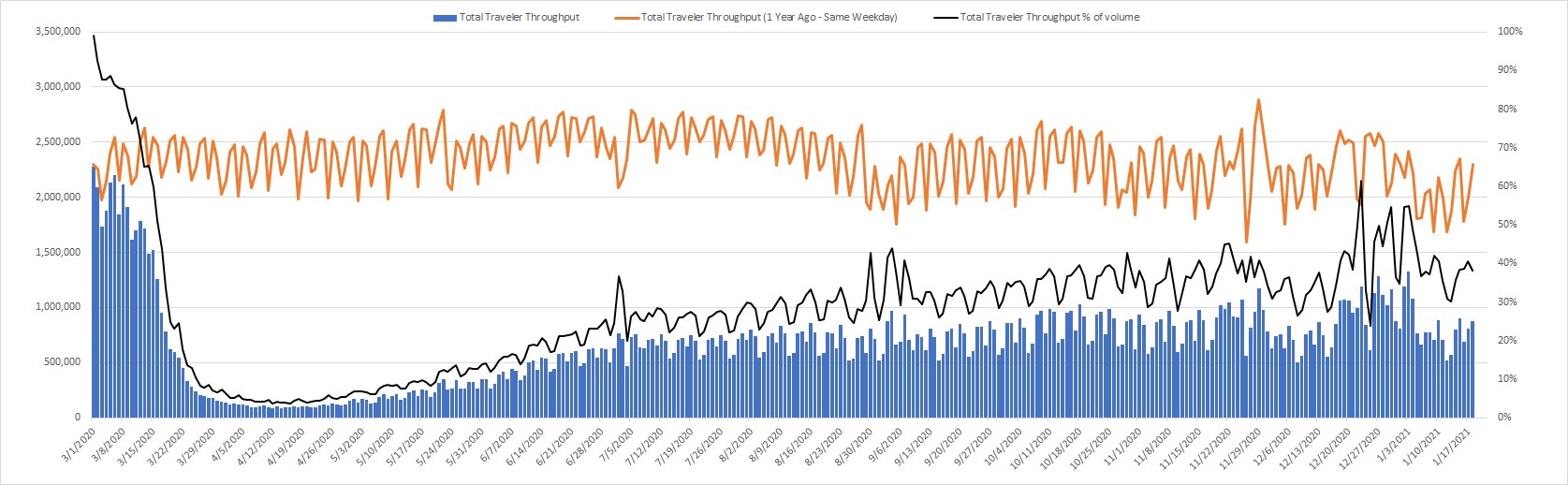

U.S. vehicle sales:

Wallstreetbets Pushes SLV To Record High

Wallstreetbets has ignited a buying frenzy in the SLV trust pushing the amount of ounces in the trust to a record high.

Labels:

silver,

slv,

Wallstreetbets

dinsdag 26 januari 2021

maandag 25 januari 2021

Iron Ore Vs. Floor Space Under Construction China

Iron ore is correlated to China construction.

Floor space under construction by property developers in China.

All the construction data for China can be found here.

China steel production data needs to be monitored.

zondag 24 januari 2021

Sibanye-Stillwater

Platinum, palladium and rhodium have all been moving higher and I expect them to go higher as China is loading more palladium and rhodium in their vehicles. China vehicle sales have rebounded as well.

Both palladium and rhodium are in deficit.

Sibanye-Stillwater has exposure to all of these metals.

SBSW's production numbers were very good.

SBSW's EBITDA was $922 million in Q3 2020. This translates to $3.7 billion EBITDA per year. With a 5 multiple, SBSW should be valued at $18 billion market cap. So there is 50% upside. The company has no net debt.

Net earnings were $1 billion per year in 2020, but is expected to rise 66% on higher rhodium/platinum prices and higher production numbers. Earnings per share are expected to be at $3.52 per share, which gives Sibanye-Stillwater a P/E of 4.8 which is very cheap.

On top of this, SBSW is expected to offer a dividend yield of 8% and is also moving into the battery metal space.

Price to book value is a bit high at 4.

vrijdag 22 januari 2021

Iron Ore

China's iron ore production is not growing.

This is because costs of production are very high in China.

China is the largest iron ore consumer and iron ore imports are growing.

China iron ore imports hit a record in 2020.

Iron ore demand is going to grow.

Brazil and Australia have the largest iron ore reserves.

donderdag 21 januari 2021

Seasonality of Commodities

Commodities should be bought during seasonally strong periods.

Corn

Oil

Natural Gas

Uranium

Lead

Cotton

Coffee

Wheat

Lumber

Labels:

commodities,

Seasonality

woensdag 20 januari 2021

dinsdag 19 januari 2021

China Power Consumption is Growing

Labels:

China,

consumption,

gdp,

power

vrijdag 15 januari 2021

Platinum to reach $2000/ounce

According to Sibanye, platinum will reach $2000/ounce in 5 years.

Labels:

platinum

donderdag 14 januari 2021

woensdag 13 januari 2021

Copper Vs. Iron Ore

Copper is a leading indicator for iron ore.

Abonneren op:

Reacties (Atom)