woensdag 27 december 2023

woensdag 20 december 2023

vrijdag 15 december 2023

CAPEX Copper

Capex for copper is declining, which means price should go up.

Goldman Sachs (NYSE:GS) foresees a supply shortfall that will drive the price of copper to $4.50 per pound by late 2024, and to more than $6.80 per pound in 2025.

Goldman Sachs (NYSE:GS) foresees a supply shortfall that will drive the price of copper to $4.50 per pound by late 2024, and to more than $6.80 per pound in 2025.

donderdag 14 december 2023

woensdag 13 december 2023

maandag 11 december 2023

zaterdag 9 december 2023

donderdag 7 december 2023

Copper Treatment charges Vs Surplus/Deficit Market Balance

As copper concentrate deficits widen, treatment charges go down in order to incentivize more supply of copper concentrate to smelters.

dinsdag 5 december 2023

dinsdag 28 november 2023

woensdag 22 november 2023

dinsdag 21 november 2023

vrijdag 17 november 2023

donderdag 16 november 2023

zaterdag 11 november 2023

Copper Expected to Rise

Copper is expected to rise to $4.5/lb according to BNEF.

Confirmed by S&P Global.

woensdag 8 november 2023

dinsdag 7 november 2023

zaterdag 4 november 2023

vrijdag 27 oktober 2023

zondag 15 oktober 2023

Housing Inventory Vs. Housing Starts

When there is too much housing inventory, then housing starts will drop.

vrijdag 13 oktober 2023

vrijdag 6 oktober 2023

woensdag 4 oktober 2023

dinsdag 3 oktober 2023

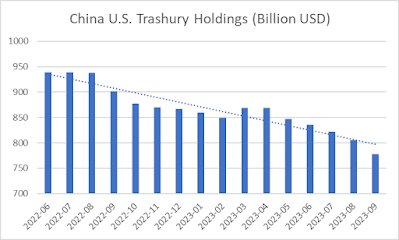

Federal Reserve Selling Bonds to Pensions

The Fed is selling trashury bonds to the pension funds, which are now deep underwater.

Pension funds buying as market cap increases, but the value of the bonds actually keeps dropping.

zondag 1 oktober 2023

vrijdag 29 september 2023

maandag 25 september 2023

Copper Checklist

To be able to time the copper market you need to take into account a lot of things. Here is a checklist.

1) Kilian Zhou Real Economy Index

The Kilian Zhou Real Economy Index tracks commodity markets.

It’s derived from a panel of dollar-denominated global bulk dry cargo shipping rates.It may be viewed as a proxy for the volume of shipping in global industrial commodity markets.

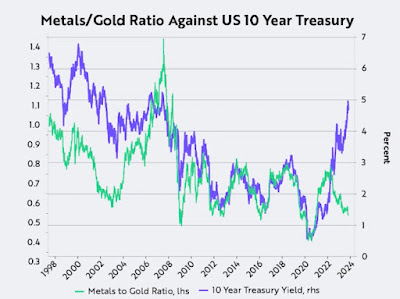

The copper/gold ratio is correlated to the 10 year bond yield.

3) Copper LME Warehouse Stock

Whenever the LME/COMEX warehouse stock level drops, there is a shortage in copper and copper prices will rise. Also check the inventory in China. SHFE copper warehouse stock can be found here. SMM bonded warehouse copper stock level can be found here.

Watch China demand for copper. High power consumption means high China GDP and higher demand for copper.

5) China Credit Impulse

The China credit impulse is a leading indicator for China GDP with a 1 year lag. Make sure it is up.

6) Shanghai Composite Index

The Shanghai Composite Index is correlated to copper price. This is because China heavily depends on commodities. We see a pennant formation shaping up and expect a breakout in 2021.7) GDP

Check the GDP forecast of the St. Louis and Atlanta Fed.

Always check that copper demand is higher than the supply of copper. Demand comes from the electrification trend. Supply is low. When mine supply goes down, copper typically moves higher.

On the supply side, miner Glencore will restart operations at the currently idled Mutanda copper mine in the Democratic Republic of Congo in 2022 (100K tonnes copper/annum) while in top producer Chile a strike at the world's largest Chile's Escondida mine threatens output (1.3 million tonnes copper/annum) and a strike at Andina Codelco copper mine (180k tonnes copper/annum) is looming. MMG's Las Bambas copper mine (400k tonnes copper/annum) had a strike in October 2021 and will shut down in mid December 2021, but reopened in January 2022 and shut down again in April 2022. Teck Resources had a strike on 13 January 2022 (120k tonnes copper/annum). Kamoa Kakula is starting production this month and will ramp up to 400K tonnes copper per year in Q3 2022. Quellaveco will start production in 2022 for 300K tonnes per year. China announced it will release its copper stockpiles into the market (China sold 20K tonnes in June, 30K in July, 30K in September and 30K in October). Stockpiles are at 2 million tonnes). On November 2023, First Quantum indicated it will need to halt production at its Cobre Panama mine, representing 300kt of production or 1.5% of global supply. An indefinite union strike plan was announced at MMG's Las Bambas copper mine in Peru starting Nov. 28 2023 (an ongoing issue at the mine since around 2016), representing another 400kt of copper production or 2% of global supply.

Oct-2025

Dec-2023:

Check the copper scrap supply in China.

Check the premium of refined copper to copper scrap. When this premium goes negative, this means that there is a shortage of copper scrap. This points to a bottom in the copper price. You can find the data here.

Operating rates: Copper rod produced with cathode (red). Copper rod produced with scrap secondary copper (blue). Buy copper when red line is higher than blue line. Typically when scrap secondary copper is scarce and trading at a premium.

9) Seasonality

Check the seasonality of copper.

The COT report gives indication of the short term moves. You want to see open interest come down and you want to see a low amount of commercial shorts.

11) Australian Dollar / Chinese Yuan

Make sure the Australian dollar and the Chinese yuan are in an uptrend.

12) Technicals

Besides all these fundamental reasons above, you need to check the technical picture as well. Buy copper when there is a breakout. (Jesse Livermore: "Follow the path of least resistance")

13) Commodity Cycles

Watch the CRB Index to see if we are in a bullish commodity cycle.

When China copper concentrate imports / China unwrought copper imports rise, commodities rise.

The Baltic Dry Index or bulk shipping rates indicate the demand for commodities. The Capesize vessels 180000 dwt are mainly used for iron ore, while the Supramax (75000 dwt) and Handymax (58000 dwt) are used for copper. HARPEX and FBX are used for container ships. China container index can be found here.

16) Yardeni Forecast

Check the Yardeni forecast for the stock market. Dr. Copper typically moves together with stocks. Follow the Yardeni China briefing numbers.

Are we in inflation or deflation? Make sure it's inflation. Segments contributing to inflation can be found at the Truflation website.

18) Zillow Rent Index

The Zillow Rent Index is a leading indicator for CPI Rent. Make sure it's up.

19) Brave-Butters-Kelley Index

The index is constructed from a large panel (490) of monthly measures of real economic activity and quarterly real GDP growth. Monthly GDP growth is indexed to the quarterly estimates from the U.S. Bureau of Economic Analysis and consists of three components: cycle, trend, and irregular.

Make sure the cycle is up.

20) Charles Nenner Cycle

21) Mannarino Index

Check the Mannarino Index. Low index means low risk, High index means high risk.

22) NAHB Housing Market

Watch the NAHB housing market index.

23) Floor Space Under Construction

As real estate accounts for 20% of China copper demand, make sure that floor space under construction is rising. Check that housing prices are going up in HK and in China.

24) Chinese Airplanes

Follow the chinese airplane data, which is correlated to copper.

25) Centa-City Leading Index

Follow HK housing market and China housing market.

26) Bonded Copper Premium

Index Chinese: https://www.minfutures.com/main/research_center/index.shtml

When the LME is more expensive than the SHFE, then China will import less copper which depresses the copper price. This is the case in beginning 2024, when the SHFE/LME ratio was very low (see red chart which is the LME cash 3m discount). The black chart is the spot/futures premium which signifies demand for copper. A high spot/futures shanghai copper premium means that China is in short supply of copper.

Chinese yields are correlated to copper.