The traditional banking system is losing status while fintech startups are growing. This also includes crypto solutions.

maandag 26 oktober 2020

vrijdag 23 oktober 2020

donderdag 22 oktober 2020

woensdag 21 oktober 2020

maandag 19 oktober 2020

vrijdag 16 oktober 2020

Oil Demand Is Stalling

Oil demand has not picked up.

Refinery inputs are not picking up.

Oil stock levels are declining but there is still too much oil out there.

Oil majors are in a lot of trouble who need an oil price of at least $50/barrel to sustain dividends.

dinsdag 13 oktober 2020

vrijdag 9 oktober 2020

List of All Correlations

Once in a while I need to post an update on all discovered correlations, we're getting a huge list already. If I only had some software to get automatic updates of these charts...

Positive correlations mean that if one goes up, the other goes up too. Negative correlations mean that if one goes up, the other goes down.

Positive correlations:

1) Silver/Gold premium Vs. Silver/Gold Price (link 2)

2) Baltic Dry Vs. Industrial Commodities

3) Baltic Dry Vs. Copper

4) Copper Vs. S&P

5) Oil Vs. Dow Jones

6) Agriculture Price Vs. Health of Economy

7) Agriculture Vs. Fertilizer Price

8) CRB Index Vs. Commodity prices (oil, agriculture, metals)

9) MZM velocity Vs. Inflation

10) MZM velocity Vs. 10 year U.S. treasury yield

11) Case-Shiller Index Vs. Housing Market Index

12) Capacity Utilization Vs. Inflation

13) Rhodium Price Vs. Automotive Industry

14) Housing Price Vs. Rise of Wages

15) O-metrix Score Vs. Stock Value

16) Outlay Spending Vs. Hyperinflation

17) Gold Money Index Vs. Gold Price

18) Stock Dividend to Bond Yield ratio Vs. Stock Price

19) War Vs. Silver Price

20) Exchange Rate Vs. Treasury Bond Valuation

21) PMI Vs. GDP Growth Rate

22) Gold Lease Rate Vs. Gold Price (link2) (link3) (link4)

23) Economy of Australia/Canada Vs. Industrial Commodities

24) Jim Sinclair's Fed Custodials Vs. Gold Price

25) LCNS silver net short positions Vs. Silver Price

26) ECB Deposit Rate Vs. Euribor and Deposit Facility (Deposit ECB)

27) China Gold Imports from Hong Kong Vs. Gold Price

28) AUD/USD Vs. Iron Ore

29) Chinese yoy GDP growth Vs. Chinese yoy Power Consumption (link 2)

30) Chinese yoy Power Consumption Vs. Chinese yoy Power Production

31) M1 and Gold

32) Obesity Vs. Debt

33) Global Equity Prices Vs. Global EPS revisions

34) Total Public Debt Vs. Interest Payment on Debt

35) U.S. Bond Yields Vs. Interest Payment on Debt

36) Federal Reserve Balance Sheet Vs. S&P

37) Federal Reserve Balance Sheet Vs. Gold Price

38) Balance Sheet Ratio Fed/ECB Vs. EUR/USD

39) China Manufacturing PMI Vs. Base Metal Prices

40) COMEX stock level Vs. CFTC Open Interest

41) Manufacturing component of Industrial Production Vs. CRB Metals Index

42) Net Short Interest Gold Vs. Gold Price

43) Central Bank Net Gold Buying Vs. Gold Price

44) LCNS silver Vs. Silver Open Interest

45) Bond Yields Vs. Gold Price

46) Gold Miners Bullish Percent Index Vs. GDX

47) Daily Sentiment Index Gold Vs. Gold Price

48) Commercial Net Short Interest Vs. Silver Price

49) Food Stamp Participation Rate Vs. Unemployment Rate

50) Bitcoin Price Vs. Gold Price

51) Credit Expansion Vs. Economic Health (second link)

52) Gold Volatility Vs. Gold Price

53) Total Stock Market Index Vs. GDP

54) Brent Crude Oil Vs. WTI Crude Oil

55) EPS revisions Vs. P/E Ratio

56) Citigroup Surprise Index (CESI) Vs. S&P

57) EPS revisions Vs. S&P

58) Dow Theory: Dow Jones Transportation Average Vs. Dow Jones Industrial Average

59) Margin Balance Vs. S&P

60) Federal Debt Growth Vs. 10 Year Treasury Yields

61) Fed Funds Rate Vs. 10 Year Treasury Yields

62) Total Central Bank Balance Sheet Vs. Gold Price

63) Large Commercial Short in Copper Vs. Copper Price

64) Bond Yields (<3%) Vs. P/E Ratio

65) ECB Lending (LTRO) Vs. Deposits at Banks

66) Disposable Income Vs. Housing Prices

67) Fixed (conventional) Mortgage Rate Vs. Treasury Yields

68) Adjustable Mortgage Rate Vs. Federal Funds Rate

69) Silver Vs. Bitcoin

70) Open Interest Trend Vs. Price Trend

71) Wage Inflation Vs. Consumer Price Index (CPI)

72) Marginal Cost of Gold Suppliers Vs. Gold Price (link 2)

73) Durable Goods Orders Vs. S&P

74) Gold ETF Trust (GLD) Vs. Gold Price

75) PMI (leading indicator) Vs. S&P Revenues

76) Federal Funds Rate Vs. LIBOR Rate

77) Lumber Price (leading indicator) Vs. Housing

78) Building Permits (leading indicator) Vs. Housing

79) Pending Home Sales Vs. Mortgage Applications

80) Employment-Population Ratio Vs. Real GDP per Capita

81) Trade Surplus/Deficit (leading indicator) Vs. Currency Strength/Weakness

82) German Treasury Yields Vs. U.S. Treasury Yields

83) Consumer Sentiment Index (leading indicator) Vs. S&P 500

84) Bitcoin Price Vs. Bitcoin Users

85) Potemkin Rally Vs. Employment to Population Ratio

86) LME Copper Warehouse Stock Level Vs. Copper Contango

87) Art Price (leading indicator) Vs. CPI

88) Total Credit Market Debt Vs. Dow Jones

89) SGE gold deliveries (leading indicator) Vs. China Gold Imports from Hong Kong (link 2)

90) Retail Sales Vs. Disposable Personal Income Per Capita

91) CRB Index Vs. Emerging Markets

92) Non Farm Payrolls Vs. Job Hires

93) Currency Debasement Vs. High Yielding Assets (Carry Trade)

94) Deposits over Loans: Excess Reserves

95) Food Price (leading indicator) Vs. Potash Price

100) Federal Funds Rate Vs. CPI

101) Full-time Vs. Part-time Workers (Recession)

102) GLD ETF Vs. COMEX Stock

103) GDP Growth Rate Vs. 10 Year Bond Yield

104) Depletion Curve Vs. Price Movement (silver, oil)

105) Managed Money Long and Short Positions (gold and silver) Vs. Gold and Silver Price (link)

106) GDP Vs. Trade Balance

107) Smart Money Flow Index (leading indicator) Vs. Dow Jones

108) Bank Deposits Vs. Deposit Rates

109) GOFO rate Vs. Gold Price

110) Federal Reserve Asset Purchases Vs. Bond Yields

111) Currency Vs. Bonds

112) Retail Sales (leading indicator) Vs. Consumer Price Index (CPI)

113) Stock Buyback Vs. S&P

114) Yen USD/JPY Carry Trade Vs. Gold (link 2)

115) Yen USD/JPY Carry Trade Vs. Stocks

116) Leading/Coincident/Lagging Indicator Vs. Recession

117) Gold per Capita Vs. Income per Capita

118) GLD ETF Stock Vs. Total U.S. ETF gold Stock

119) Gold Repatriation Vs. Recession

120) Dividend Yield Vs. Bond Yield

121) Misery Index Vs. Gold

122) Palm Oil (leading indicator) Vs. Soybean Oil Vs. Crude Oil

123) Junk Bonds Vs. Stock Market

124) Junk Bonds Vs. Energy Junk Bonds Vs. Oil

125) P/E Ratio Vs. M/O Age Ratio

126) Tax Revenues Vs. Stock Markets

127) Employment to Population Ratio (leading indicator) Vs. Wage Growth

128) Equity Valuation Vs. Q Ratio (James Tobin)

129) Chapwood Index Vs. CPI

130) Working Age Population (15-24) Vs. CPI

131) ISM Manufacturing PMI (leading indicator) Vs. ISM Services PMI

132) Global FX Reserves Vs. Global Equities

133) Corporate Loan Charge-Offs and Delinquencies Vs. Federal Funds Rate (leading indicator)

134) Breadth Advance-Decline Line (leading indicator) Vs. Stocks

135) USD/CNY Vs. Crude Oil

136) USD/CNY (leading indicator) Vs. S&P

137) Corporate Profits (leading indicator) Vs. Employment

138) Debt to GDP (leading indicator) Vs. Default Rate

139) African Rand Vs. Silver

140) GDP Output Gap (leading indicator) Vs. Inflation

141) Yield Curve (leading indicator) Vs. Coincident Indicator

142) GDP (leading indicator) Vs. Oil

143) Credit Risk: LIBOR (leading indicator) Vs. Fed Funds Rate

144) Cross-Asset Correlation Vs. Gold

145) Quits Rate (leading indicator) Vs. Wage Inflation

146) Rig Count (leading indicator) Vs. Oil Production

147) U.S. Dollar Liquidity Vs. Emerging Market Stocks

148) Loan Growth Vs. Interest Rates

149) Copper/Gold Ratio Vs. 10 Year Bond Yield

150) Bond Yields Vs. Unrealized Losses Federal Reserve

151) Trade War Vs. Inflation Vs. GDP

152) Gold/Silver Minus Oil Vs. HUI

153) Silver Depletion Vs. Silver Production

154) Yield Curve Vs. Net Interest Margin

155) PPI (leading indicator) Vs. CPI

156) LIBOR Vs. Jumbo CD

157) Initial Jobless Claims (leading indicator) Vs. Unemployment Rate

158) Yield Curve Vs. Net Interest Margin

159) 3-2 Year Yield (leading indicator) Vs. 2-1 Year Yield

160) Open Interest Vs. Gold Price

161) 2 Year Yield (leading indicator) Vs. Fed Funds Rate

162) Gold Vs. Negative Yielding Debt

163) AAA Credit Spread (leading indicator) Vs. Real GDP

164) Maturity of Debt Vs. Debt to GDP

165) SHFE Silver Warehouse (leading indicator) Vs. Silver Price

166) Freights Vs. Real GDP

167) PSLV Vs. Silver Price

168) Chinese Yuan Vs. Chinese Foreign Exchange Reserves

169) OECD Leading Index (leading indicator) Vs. S&P Revenue

170) China Credit Impulse (leading indicator) Vs. China GDP

171) Credit Card Interest Rate Vs. 10 Year Bond Yield

172) SOFR Vs. LIBOR

173) QE Vs. Yield Curve

174) Suicide Rate Vs. Unemployment Rate

175) Germany IFO Index (leading indicator) Vs. Germany GDP

176) Chinese Yuan Vs. China Errors and Omissions in Balance of Payments

177) NVT/RVT Vs. Bitcoin

178) Yardeni FSMI Vs. S&P

179) Gold Open Interest Vs. Gold Price

180) QE (leading indicator) Vs. PMI

181) Monetary Base/Money Supply Vs. Gold Reserves

182) China GDP Vs. Gold Price

183) New Home Price (leading indicator) Vs. Rent CPI

184) Delinquencies (leading indicator) Vs. Unemployment Rate

185) Taylor Rule Rate (leading indicator) Vs. Gold Price

186) Commercial Paper Rates Vs. Repo

187) Cass Freight Index Vs. Real GDP

188) PCE Vs. CPI

189) Profits Before Tax (leading indicator) Vs. Stock Market

190) Disposable Income Vs. Housing

191) VIX Vs. Margin Debt Gold Selling

192) LBMA Spot Gold/Silver Vs. COMEX Gold/Silver Futures

193) Net International Investment Position (NIIP) Vs. Current Account

194) Debt to GDP Vs. Stagflation

195) Air Traffic Vs. Oil Vs. Stocks

196) Air Freight Vs. Trade Balance

197) Conceptions Vs. GDP

198) Mexican Peso Vs. Silver Price

199) PCE Vs. GDP

200) AUD (leading indicator) Vs. CNY

201) Gold Miner Hedging Vs. Gold Lease Rate

202) Budget Deficit Vs. Gold Price

203) Backwardation in Lease Rate (leading indicator) Vs. Silver Price

204) Silver Margin Hike Vs. Silver Volatility

205) COMEX Deliveries Vs. Gold Price

206) Rhodium (leading indicator) Vs. Palladium

Negative correlations:

1) Copper Price Vs. Copper Futures Contango

2) Interest Rates (bond yields >3%) Vs. P/E ratio of gold mines

3) Non-Farm Payrolls Vs. Unemployment Rate

4) Federal Debt Held by Foreigners Vs. U.S. Bond Yields

5) Size of Governments Vs. Their Economies

6) Stocks Vs. U.S. Dollar

7) Silver Stock at CME Vs. Silver Price

8) China Reserve Requirements Vs. Shanghai Real Estate Prices

9) Capacity Utilization (leading indicator) Vs. Unemployment Rate

10) Net Commercial Short Positions Vs. Bond Yields (Alternative Site)

11) Net Non-Commercial Long Positions Vs. Bond Yields

12) % Change in Gold Vs. Real Interest Rates on 10 Year Treasuries

13) Shanghai Silver Premium Vs. Silver Price

14) Probability of Recession Vs. 10 year - 3 year Yield Spread (link 2)

15) Junk Silver Premium Vs. Silver Price

16) Wage Inflation Vs. Unemployment Rate

17) Initial Unemployment Claims Vs. S&P

18) Gold/Silver Ratio Vs. S&P

19) GLD Flows Vs. Shanghai Gold Premium

20) Unemployment Rate Vs. Real GDP (leading indicator)

21) Mortgage Rates Vs. Mortgage Applications

22) Single Family Housing Starts Vs. Unemployment Rate

23) Tax Revenue Vs. Personal Savings Rate

24) Change in Non-Farm Payrolls Vs. Change in Unemployment Rate

25) Fed Funds Rate Vs. Unemployment Rate

26) Labor Force Participation Rate Vs. Unemployment Rate

27) M1 Money Supply (leading indicator) Vs. CPI

28) GOFO Vs. Gold Premium

29) Shanghai Silver Inventory Vs. Shanghai Silver Premium

30) Misery Index Vs. Forward P/E Ratio

31) Flattening Yield Curve Vs. Fed Funds Rate

32) Oil Contango Vs. Oil Price

33) Business Inventory to Sales Ratio (leading indicator) Vs. GDP Growth

34) QE (leading indicator) Vs. Deficit

35) Credit Spread (leading indicator) Vs. S&P

36) Gold/Silver Ratio Vs. CPI

37) Temporary Workers Vs. Recession

38) Stock to Use Ratio Vs. Agriculture Price

39) Help Wanted Online Ads (leading indicator) Vs. Unemployment Rate

40) Federal debt held by foreigners Vs. 10 Year U.S. Yield

41) Economic Policy Uncertainty (leading indicator) Vs. GDP Growth

42) U.S. Treasury Cash Balance Vs. Monetary Base

43) Gold Price Vs. Gold Production

44) Yield Curve (leading indicator) Vs. VIX

45) Copper/Zinc/Lead Production Vs. Silver Price

46) Youth Employment Vs. Initial Jobless Claims

47) Maturity of Debt Vs. Budget Deficit

48) Put/Call Ratio Vs. Stocks

49) Non-Farm Payroll (leading indicator) Vs. Unemployment Rate

50) Household Durables Good Time to Purchase (leading indicator) Vs. Unemployment Rate

51) Productivity Vs. Inflation

52) Phillips Curve: Unemployment Vs. Inflation

53) Palladium/Platinum COMEX Stock Vs. Palladium/Platinum Price

54) Oil Vs. CCC Junk Bonds

55) Savings-Investments Vs. Housing

56) COMEX Silver Vs. Silver Price

57) COT Swap Dealers Vs. Gold Price

58) Existing Home Sales Vs. Housing Inventory

59) Oil Inventories Vs. Rig Counts

60) Outstanding Shorts Vs. Stock Price

These are a lot of correlations that you need to monitor on a day to day basis!

Thermodynamic Oil Collapse

dinsdag 6 oktober 2020

zondag 4 oktober 2020

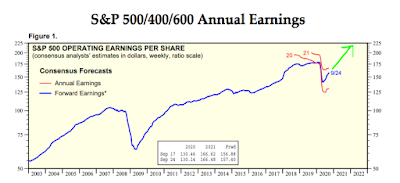

Stocks during Great Depression

During the Great Depression, earnings went down along with stocks.

Today, earnings are not going down, but up.

zaterdag 3 oktober 2020

U.S.A. Debtor Nation

The latest Q2 2020 numbers came out for the Net International Investment Position of the U.S.A. It doesn't look good.

vrijdag 2 oktober 2020

Savings Vs. Housing

When people have a lot of savings, they will be able to buy a lot of houses and the housing market goes up.