Small update on premiums. I see very good news for precious metals investors.

Even though silver dropped to its low of $18.7/ounce, miners have not dropped prices of silver bullion. The result is a record high premium to get your hands on physical silver. It's amazing that these silver producers won't drop their selling price. For months we have had a selling price of $23/ounce.

APMEX silver premiums are steady.

Junk silver premium is bottoming out.

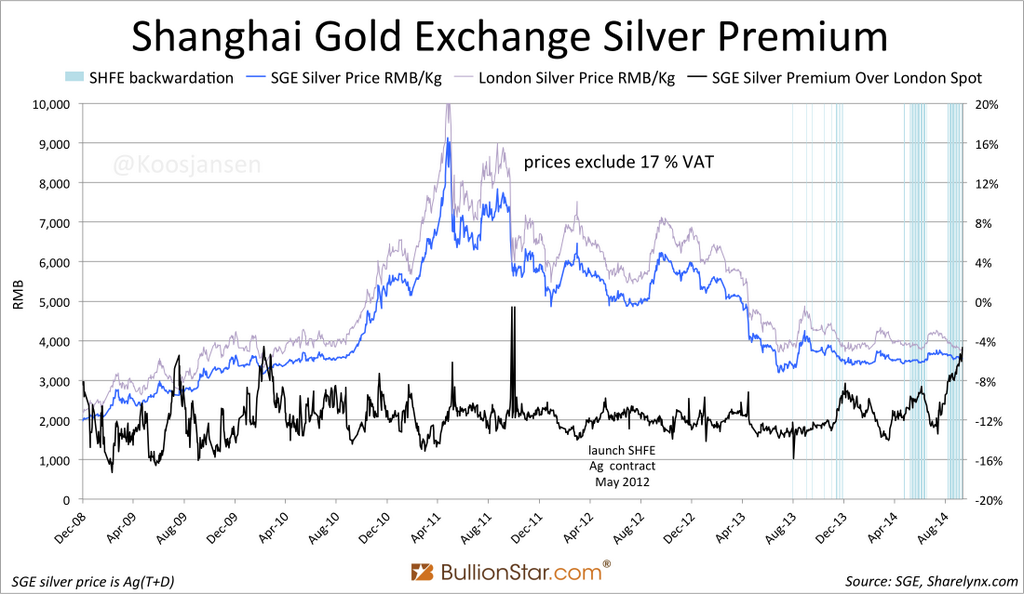

Shanghai silver premiums are soaring to almost 13%. If this goes to 20% (above the 17% VAT tax) we will see arbitrage opportunities.

Remember, this 13% premium is the highest since 2008.

While Shanghai gold premiums are zero, but rising! That means China could start raiding the GLD again and we see that GLD reported very low stock numbers recently.

APMEX gold premiums are up again.

Even though silver dropped to its low of $18.7/ounce, miners have not dropped prices of silver bullion. The result is a record high premium to get your hands on physical silver. It's amazing that these silver producers won't drop their selling price. For months we have had a selling price of $23/ounce.

APMEX silver premiums are steady.

Junk silver premium is bottoming out.

Shanghai silver premiums are soaring to almost 13%. If this goes to 20% (above the 17% VAT tax) we will see arbitrage opportunities.

Remember, this 13% premium is the highest since 2008.

|

| BullionStar.com |

While Shanghai gold premiums are zero, but rising! That means China could start raiding the GLD again and we see that GLD reported very low stock numbers recently.

APMEX gold premiums are up again.

Geen opmerkingen:

Een reactie posten