Current status of energy market.

The oil price (link 2, link 3) can be predicted based on oil supply and demand numbers. Demand can be correlated to U.S. GDP while supply can be correlated to production. I added the Chinese yuan exchange rate to include Chinese oil demand, which is a large part of oil demand.

The same chart below but GDP substituted by credit spreads.

The oil price is a leading indicator for rig counts. If you see the oil price (green line) go down, the rig count (blue line) will go down as well. Later on, the oil production (light blue line) will go down.

Oil price = Green line

Rig counts = Blue line

Rig counts = Blue line

Oil production = Light blue line

Macro-economic indicators from the EIA should be monitored. Check the latest news here.

- Shale gas production (decline rates)

- U.S. natural gas storage Robry model

- EU natural gas storage (link 2)

- EU natural gas demand

- Fair value price of gas

- EU electricity production by source

- LNG production and LNG price

- Weather forecast and polar vortex

- Distillate demand and China oil demand

- Global oil supply and demand

- Oil refinery demand

- Crack spreads

- Bullish percentage index

- Drilled Uncompleted Wells and Shale oil/gas production (Permian/Haynesville/Appalachia/Bakken/Anadarko/Eagle Ford/Niobrara)

- Baker Hughes rig count or Enverus rig counts or oil/gas rig counts (link 2)

- Refinery net production

Make sure to check the uranium price because uranium is a leading indicator for oil.

Make sure to check the GDP outlook from the Atlanta Fed.

Check the bullish percentage energy index. Alternative link.

Check the fair value price of gas.

Check the seasonality on oil and gas.

Check natural gas consumption.

Check the WCS-WTI differential. WCS should close in on WTI due to the Trans Mountain Pipeline going in production in 2024.

Check that oil open interest is rising (leading indicator).

Check oil inventories.

Check natural gas inventories.

Oil CAPEX is at decade lows and should support higher oil prices. Watch the oil CAPEX/Sales ratio. Whenever this is below historic average, you are in an oil bull market.

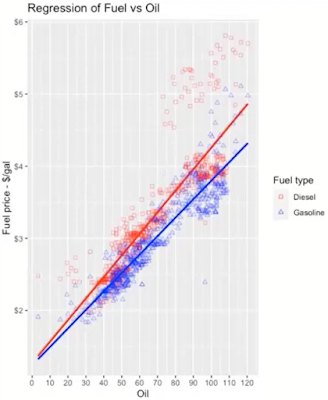

Check the correlation between oil and gasoline/diesel/natgas via crack spreads. Crack spreads are a 1-month leading indicator for oil prices.

2023

Oil price in function of demand.

Check energy as a percentage of the SP500.

Nenner forecast.

Geen opmerkingen:

Een reactie posten