Problems ahead... The Fed lost control of the Fed funds rate and the repo rate. They needed to inject $80 billion in liquidity to close the gap (for now already 3 days in a row).

Look at the spike in libor rate/fed funds rate in Sep 2019. This happened before in 2008 and QE of $1 trillion dollars was needed. So I expect that we will have QE4 soon.

You might wonder: "Why don't banks use their excess reserves at the Fed?" The reason is Basel III Liquidity Coverage Ratio (LCR). LCR = Liquid assets / Net Cash Flow. So the Fed is officially stuck.

The LCR was implemented and measured in 2011, but the full 100% minimum was not enforced until 2015. The liquidity coverage ratio applies to all banking institutions that have more than $250 billion in total consolidated assets or more than $10 billion in on-balance sheet foreign exposure. Such banks, often referred to as "Systematically Important Financial Institutions (SIFI)," are required to maintain a 100% LCR, which means holding an amount of highly liquid assets that are equal or greater than its net cash flow, over a 30-day stress period. Highly liquid assets can include cash, Treasury bonds or corporate debt.

Look at the spike in libor rate/fed funds rate in Sep 2019. This happened before in 2008 and QE of $1 trillion dollars was needed. So I expect that we will have QE4 soon.

You might wonder: "Why don't banks use their excess reserves at the Fed?" The reason is Basel III Liquidity Coverage Ratio (LCR). LCR = Liquid assets / Net Cash Flow. So the Fed is officially stuck.

The LCR was implemented and measured in 2011, but the full 100% minimum was not enforced until 2015. The liquidity coverage ratio applies to all banking institutions that have more than $250 billion in total consolidated assets or more than $10 billion in on-balance sheet foreign exposure. Such banks, often referred to as "Systematically Important Financial Institutions (SIFI)," are required to maintain a 100% LCR, which means holding an amount of highly liquid assets that are equal or greater than its net cash flow, over a 30-day stress period. Highly liquid assets can include cash, Treasury bonds or corporate debt.

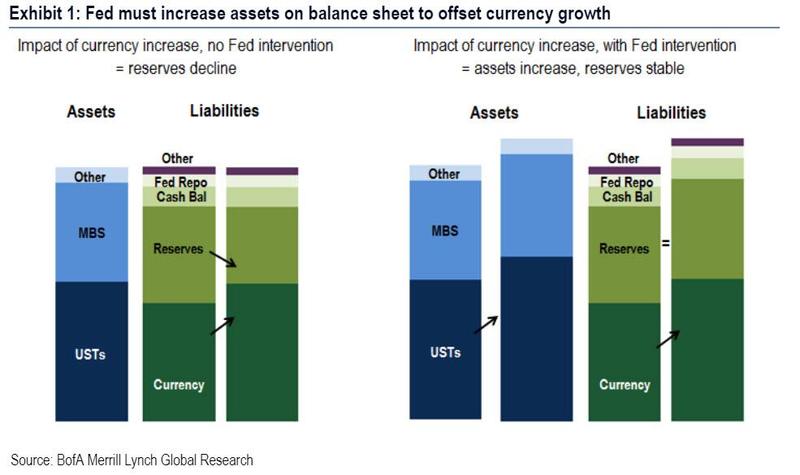

The actual problem is that while currency increases, the bank reserves are declining. So the Fed needs to initiate QE to keep the reserves steady. If it didn't do QE, then the Fed funds rate would spike.

Geen opmerkingen:

Een reactie posten