Let's take a 10 year Belgian government bond at 5% (Chart 1). Suppose I bought an amount of 1000 euro of these bonds. This means that after 10 years I get paid with: 1000 + 10*5%*1000 = 1500 euro.

Indeed, after 10 years I made 50% profit on the principal. 1000 euro became 1500 euro.

|

| Chart 1: Belgium 10 Year Government Bonds |

|

| Chart 2: Belgium 10 Year Government Bonds |

Let's reperform the calculation. If I buy an amount of 1000 euro of these 10 year Belgian bonds. I get repaid with: 1000 + 10*2.65%*1000 = 1265 euro.

So after ten years my 1000 euro becomes 1265 euro. That's a 26.5% profit in 10 years.

Now comes the clue. If I sell my 10 year Belgian bonds (with 5% interest) on the market, as compared to the current rate of 10 year Belgian bonds today (with 2.65% interest), I will make profit.

That profit is: 1500 - 1265 euro = 235 euro.

How much percent profit is that? 235/1000 = 23.5%

That's a pretty high profit if you ask me. Gold has been doing worse in those 7 months, it went up only 5% in euro terms.

Now let's go a bit further. If the interest would be cut in half again from 2.65% to 1.25%, what will be my profit?

1265 - 1125 euro = 140 euro

My percentage profit = 140/1000 = 14%

And when it gets cut in half again from 1.25% to 0.625%.

1125 - 1062.5 = 62.5 euro

My percentage profit = 62.5/1000 = 6.2%

And when it gets cut in half again from 0.625% to 0.312%.

1062.5 - 1031.2 = 31.3 euro

My percentage profit = 31.3/1000 = 3.1%

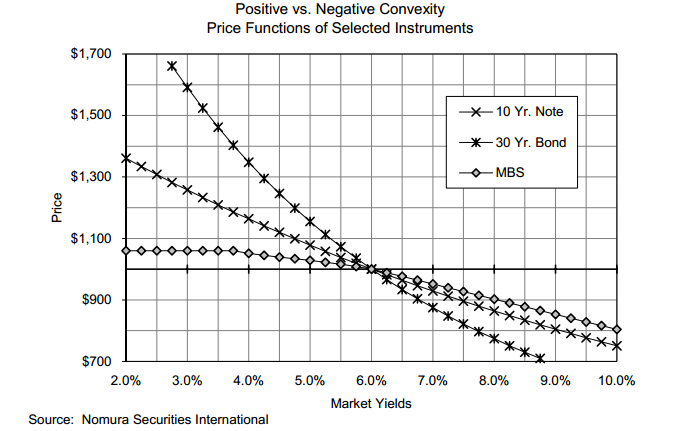

You see, the lower the interest rate is, the less profit you can make in proportion to the yield cut. I can't understand how people still want to buy these government bonds at these low yields.

Talking about a bond bubble... it's staring right in your face. U.S. 10 year government bonds are now at 1.5%. If that yield would go to 0%, you could make only 15% profit. Gold will ultimately go much higher than this 15%.

Edit:

I still haven't figured out how to calculate the yield-price bond curve the correct way. But instead I'll just use the Nomura curve here, much easier:

Geen opmerkingen:

Een reactie posten