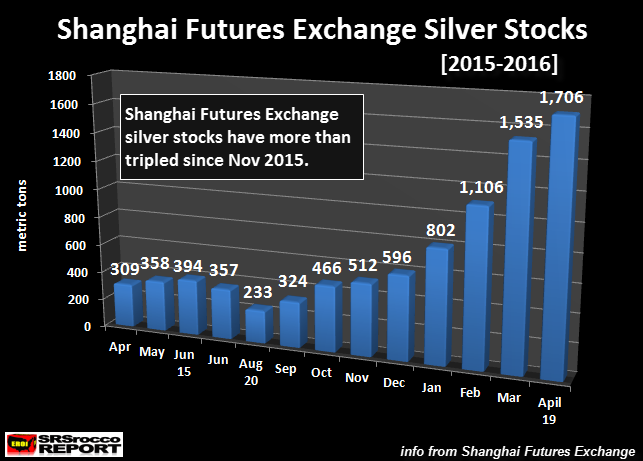

It is not a coincidence that the COMEX registered silver stock went down since 2015 (-1250 metric tonnes), while the Shanghai silver stocks are going up at the same time since 2015 (+1500 metric tonnes). And this stockpiling really accelerated in 2016 when the silver price started to take off. So basically China is buying up the COMEX physical stock. I wonder how long this will continue. The answer, not long: maximum 6 months. Then the silver price will blow up higher, because there is no way China will be selling that silver.

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M1 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

maandag 27 juni 2016

zaterdag 25 juni 2016

Flight to Safety

Status on how big each asset is these days.

Labels:

Martenson

Gold is going a lot higher

Just a few items to evidence that gold is going a lot higher.

1: GLD added 20 tonnes in one day yesterday. The correlation suggests we should already be 20% higher at $1500/ounce.

2: First Majestic Bullion Store increased premiums to $19/ounce.

3: Junk silver is out of stock

4: Google trends sees an increase in: "Buy Gold" searches.

1: GLD added 20 tonnes in one day yesterday. The correlation suggests we should already be 20% higher at $1500/ounce.

2: First Majestic Bullion Store increased premiums to $19/ounce.

3: Junk silver is out of stock

4: Google trends sees an increase in: "Buy Gold" searches.

Labels:

Gold

vrijdag 24 juni 2016

The Consequences of Brexit

On June 24th, 2016, Britain voted to leave the EU. The immediate reaction was an 8% plunge in the Nikkei, financials dropped between 10-30%, negative bond yields went even more negative and gold surged 8%. George Soros predicted that we would have a 20% drop in pound and he was right. These are large moves and this is my take on what investors should be doing next.

Read further here.

Read further here.

Labels:

Brexit

zondag 12 juni 2016

Stock to Use Ratio Vs. Agriculture Prices

The stock to use ratio indicates the level of carryover stock for any given commodity as a percentage of the total use of the commodity. The stocks-to-use ratio is technically an indicator of supply relative to demand in quantity terms. So when the stock to use ratio goes down, prices go up. Let's illustrate this with some graphs.

The CME regularly reports the latest stock to use ratios here. For example, corn STU ratios can be found here.

Corn prices can be found in the chart below:

When analyzing both charts, we see that when the STU ratio went down in 2010-2011, we saw a price spike in corn a few years later (2011-2012). Then the STU ratio went up in 2013-2014 and consequently we saw a drop in corn prices in 2014-2015. As the STU ratio is topping off again in 2016, I expect to see a rise in corn prices very soon. The rise in corn prices is also supported by the rough weather in Brazil.

Let's look at wheat. The wheat STU ratio has ween going up since 2006, so it's clear we have an oversupply in wheat.

Wheat prices have also been dropping since 2006, with a small upside correction in 2010-2012 when STU ratios went down. Looking at the trend in STU ratio, I don't see a bullish pattern in wheat at this moment.

As for soybeans, we have the following chart. The STU ratio crashed in 2007 and this lead to a doubling of the soybean price in that year. Today in 2016, we see a similar trend where both world and U.S. STU ratios crash down, so I expect that soybean prices will do well going forward. Reports of Brazil having too dry weather and Argentina having too wet weather have supported soybean prices.

The CME regularly reports the latest stock to use ratios here. For example, corn STU ratios can be found here.

Corn prices can be found in the chart below:

When analyzing both charts, we see that when the STU ratio went down in 2010-2011, we saw a price spike in corn a few years later (2011-2012). Then the STU ratio went up in 2013-2014 and consequently we saw a drop in corn prices in 2014-2015. As the STU ratio is topping off again in 2016, I expect to see a rise in corn prices very soon. The rise in corn prices is also supported by the rough weather in Brazil.

Let's look at wheat. The wheat STU ratio has ween going up since 2006, so it's clear we have an oversupply in wheat.

Wheat prices have also been dropping since 2006, with a small upside correction in 2010-2012 when STU ratios went down. Looking at the trend in STU ratio, I don't see a bullish pattern in wheat at this moment.

As for soybeans, we have the following chart. The STU ratio crashed in 2007 and this lead to a doubling of the soybean price in that year. Today in 2016, we see a similar trend where both world and U.S. STU ratios crash down, so I expect that soybean prices will do well going forward. Reports of Brazil having too dry weather and Argentina having too wet weather have supported soybean prices.

vrijdag 10 juni 2016

Platinum is looking better and better

Since the start of 2015, the price of platinum has dropped significantly. To show you how undervalued platinum is today, I like to compare it to the price of gold (see charts below). Historically, platinum should be priced higher than gold because it is rarer than gold. This all changed after 2015 when the gold price started to move above the price of platinum. Today, platinum costs $1000/ounce while gold costs $1260/ounce. So we are seeing an interesting arbitrage opportunity of an immediate 30% increase in the price of platinum.

To see the analysis, go here.

To see the analysis, go here.

donderdag 9 juni 2016

Deutsche Bank is going down

This is Deutsche Bank's stock.

And these are 10 year U.S. treasuries.

Let's zoom in to 2016:

That's a very nice correlation right? So if the 10 year U.S. treasuries break downwards, what do you get? We get a plunge in Deutsche Bank's stock. The question is: "Will the 10 year U.S. yield plunge?". I say yes, because we see that the U.S. is going into a recession with very slow GDP growth. Also, Janet Yellen will need to use negative interest rates to combat the plunging yields. If Janet raises interest rates, we will see a flattening yield curve and even lower 10 year U.S. yields. Or Janet needs to initiate QE4, which will make 10 year bond yields go up again against a weakening dollar.

None of this will happen soon, so I expect Deutsche Bank to go the way of Lehman Brothers soon. Watch out, because we are hitting downside resistance here.

And these are 10 year U.S. treasuries.

Let's zoom in to 2016:

That's a very nice correlation right? So if the 10 year U.S. treasuries break downwards, what do you get? We get a plunge in Deutsche Bank's stock. The question is: "Will the 10 year U.S. yield plunge?". I say yes, because we see that the U.S. is going into a recession with very slow GDP growth. Also, Janet Yellen will need to use negative interest rates to combat the plunging yields. If Janet raises interest rates, we will see a flattening yield curve and even lower 10 year U.S. yields. Or Janet needs to initiate QE4, which will make 10 year bond yields go up again against a weakening dollar.

None of this will happen soon, so I expect Deutsche Bank to go the way of Lehman Brothers soon. Watch out, because we are hitting downside resistance here.

Labels:

10 year,

Bankrupt,

Deutsche Bank,

treasuries,

U.S.

woensdag 8 juni 2016

Valuation of gold mineral resources and reserves

When valuing an exploration company, you should know that gold in the ground isn't worth a lot. Typically between $0-90/ounce. No matter what the gold price does, it is still worth between that range. What does matter is the amount of gold ounces you have in the ground and the grade and shallowness of the gold resources.

When you start as an explorer, your resources will be priced between $0-30/ounce. When you have done feasibility studies and gained mineral reserves your gold will go up to the $90/ounce range.

So let's say Balmoral Resources has 5 million ounces of gold resources. It could be that the company could be bought out by 5 million * $30/ounce = $150 million dollars. Which is twice the market cap today. The price of gold doesn't have a lot of influence, but let's say they find 7 million ounces of gold, then the buyout price would be $210 million dollars. And let's say they find very high grade gold, then it could be even higher. For example 7 million * $50/ounce = $350 million dollars. This is 5 times the current market price.

So everything depends on their progress in drilling holes and finding large resources and high grades. All speculation, but it can be very rewarding.

dinsdag 7 juni 2016

Temporary workers Vs. Recession

Temporary workers are easy to fire and that's why they are a leading indicator for a recession.

Labels:

correlation,

recession,

temporary,

workers

maandag 6 juni 2016

Balmoral Resources

By now investors are already aware of the new bull market in gold and one of the best ways to cash in on this is to buy high quality mining companies. In this article I want to introduce a gold exploration company that is still in its early stages of development: Balmoral Resources (BALMF).

The company is focused on 2 projects: the high-grade Martiniere gold system and the large H3 (Grasset) nickel-copper-PGE discovery (see map below). What I like very much is that the La Martiniere deposit is located just 40 km from Detour Gold's Detour Lake Mine, which has a production of 650k gold ounces per year and 16 million ounces of gold reserves. So there is a high chance that a partnership could materialize between Detour Gold and Balmoral Resources. There are examples of such partnerships where a producing mine buys the exploration company and hands out royalties: see my article on Golden Arrow Resources (GARWF). Other than Detour Gold, we have Hecla's Casa Berardi mine in the western part of Quebec and Glencore's Matagami mine to the east. So there are plenty of partnership and financing possibilities.

Read further here.

The company is focused on 2 projects: the high-grade Martiniere gold system and the large H3 (Grasset) nickel-copper-PGE discovery (see map below). What I like very much is that the La Martiniere deposit is located just 40 km from Detour Gold's Detour Lake Mine, which has a production of 650k gold ounces per year and 16 million ounces of gold reserves. So there is a high chance that a partnership could materialize between Detour Gold and Balmoral Resources. There are examples of such partnerships where a producing mine buys the exploration company and hands out royalties: see my article on Golden Arrow Resources (GARWF). Other than Detour Gold, we have Hecla's Casa Berardi mine in the western part of Quebec and Glencore's Matagami mine to the east. So there are plenty of partnership and financing possibilities.

Read further here.

zaterdag 4 juni 2016

Weird Things Happening at COMEX

You have got to see this.

A huge inflow was seen yesterday at the COMEX in registered gold and I mean huge. We haven't seen these kind of numbers since 2013.

My correlations suggest that the GLD ETF is seeing the same inflows when this happens and I checked GLD yesterday and yes, we saw another 10 tonnes of gold inflows at the start of the month of June 2016. This bodes very well for the price of gold.

For silver we see continued tightening in physical silver. I expect to see silver explode in a month or two from now when the blue line intersects with zero.

A huge inflow was seen yesterday at the COMEX in registered gold and I mean huge. We haven't seen these kind of numbers since 2013.

My correlations suggest that the GLD ETF is seeing the same inflows when this happens and I checked GLD yesterday and yes, we saw another 10 tonnes of gold inflows at the start of the month of June 2016. This bodes very well for the price of gold.

For silver we see continued tightening in physical silver. I expect to see silver explode in a month or two from now when the blue line intersects with zero.

vrijdag 3 juni 2016

Calculating profit on negative bond yields

In a world of negative interest rates where you need to pay money to hold bonds, we ask ourselves why do people still buy these bonds?

Well it appears that buying bonds can still be profitable at negative interest rates as long as the yield keeps going down. But there is a limit. Let's calculate this limit.

Here is the formula:

For example: if a 10 year bond has bond yields go down 1% per annum, you can make huge profits (around 10% profit). The question is, will bond yields go down 1% per annum? Is this sustainable?

For more charts, go here.

Well it appears that buying bonds can still be profitable at negative interest rates as long as the yield keeps going down. But there is a limit. Let's calculate this limit.

Here is the formula:

For example: if a 10 year bond has bond yields go down 1% per annum, you can make huge profits (around 10% profit). The question is, will bond yields go down 1% per annum? Is this sustainable?

For more charts, go here.

Labels:

bond yield

woensdag 1 juni 2016

ECB: Deposit Inflows in Euro Area Continue in April 2016

The April 2016 numbers are out for the deposits in Europe and I can say that the ECB can lower interest rates some more, because I don't see any deposit flights at all.

Abonneren op:

Posts (Atom)