The LIBOR rate at which the banks lend each other money, is an important element in calculating the gold lease rate. Obviously, this LIBOR rate is influenced by the Federal Reserve via the Fed Funds Rate.

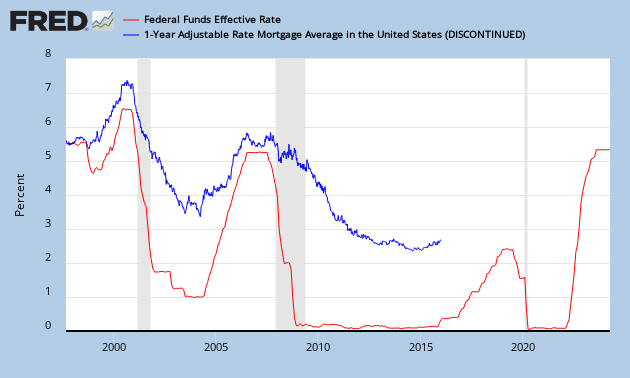

As you can see on this chart, there is an almost 100% correlation between LIBOR and the Fed Funds Rate.

As the Federal Reserve said that they will keep interest rates at zero until 2015, LIBOR rates will keep floating around the 0% level.

This also means that the gold lease rate (LIBOR minus GOFO (Gold Forward Rate)) is entirely dependent on the GOFO rate as long as the Federal Reserve keeps interest rates near zero.

Once inflation begins to pick up though, the Federal Reserve will have to raise the Fed Funds Rate (contractionary monetary policy), which will increase LIBOR rates and this will tend to raise the gold lease rates. In turn, high gold lease rates are a bullish environment for gold prices.

Note that there is one power that will force the Federal Reserve to increase its Fed Funds Rate and that is the yields on the bond market and the mortgage market.

As you can see on this graph below, the adjustable mortgage rates are starting to edge upwards even with a zero interest rate policy. Government bond yields are also edging upwards. So eventually, the Federal Reserve will be pressured to increase interest rates to keep up with the rise in bond and mortgage yields.

Geen opmerkingen:

Een reactie posten