With crude oil going back over $106/barrel (which is a 20% increase from $90/barrel), let's see how the CPI would do.

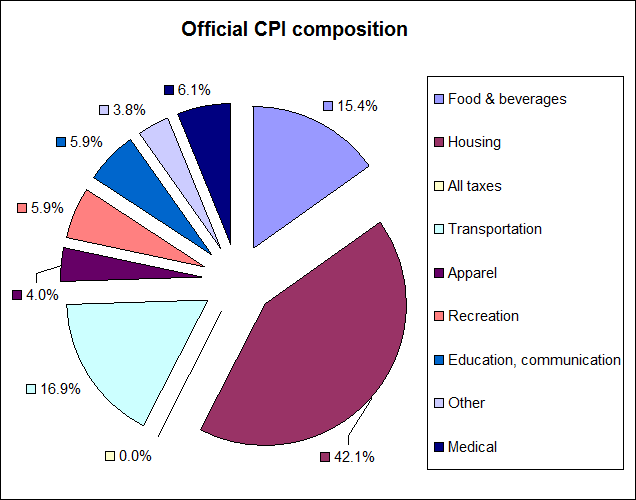

As you know, the consumer price index consists mostly of housing (42%), then second comes transportation (17%) and last comes food (15%).

The crude oil is part of the transportation segment. One third of the transportation segment is motor fuel or 5% of the CPI.

So if oil prices go up 20%, the CPI will only go up 20% x 5% = 1%.

More importantly, housing determines a major part of the CPI. Half of the housing segment consists of Owners’ equivalent rent of residences which is basically the amount of rent you would pay for staying in the house. This depends on the housing prices. 10% of the housing segment is fuel and utilities. So if oil goes up 20%, the housing segment will go up 10% x 20% = 2%. And the CPI would go up 2% x 40% = 1%.

|

| CPI |

So that's the significance of the oil price on the CPI.

Geen opmerkingen:

Een reactie posten