|

| Central Bank Balance Sheet Expansion is Bad for the Currency |

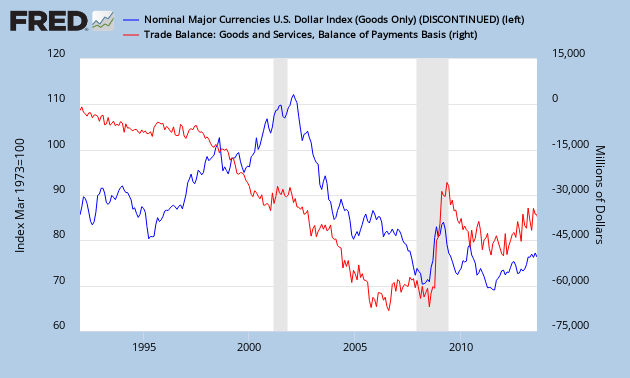

Moreover, we see that the Eurozone has a trade surplus while the U.S. and Japan have a trade deficit, which according to this correlation below, is good for the euro and bad for the U.S. dollar and Japanese yen.

|

| Deficit is correlated to Currency Valuation |

This also means that U.S. and Japanese bonds will continue their decline as following correlation between currency and bond yields suggests.

You see, this is the power of correlations... Maybe I should rename this blog to: "Correlation Economics".

Geen opmerkingen:

Een reactie posten