Some people say lithium will still go up in 2022.

Chamath says lithium will be the best performing asset in 2022.

Lithium seems to have a huge future.

Lithium is in deficit.

Rio Tinto projection.

Savannah resources projection.

Lithium battery demand will grow.

Mostly due to EVs.

Deficit will grow.

Lithium market balance by benchmarkminerals.

We need a lot of lithium to transition from fossil fuels.

Short term we could have a bumpy ride.

And all mines are currently already in production at the current lithium price.

Same for spodumene.

Even if lithium prices soar, this doesn't have a significant effect on EV prices.

A battery pack is 50% material cost.

Of that cathode material cost, lithium is half of that cost. LFP batteries are the cheapest so I expect lithium demand to grow faster as they use more LFP batteries in the future.

Costs have risen in 2022.

The EV penetration rate in China was supposed to be 10% in 2021.

Instead it is almost 15% in 2021 and going to 25% in 2022.

Lithium recycling will come in later. You first need to build batteries before they can be recycled.

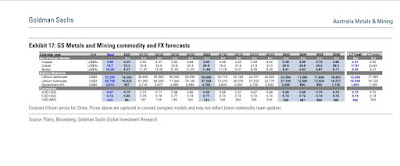

However, Goldman Sachs thinks lithium will cool off.

Deze reactie is verwijderd door de auteur.

BeantwoordenVerwijderenThx!

BeantwoordenVerwijderen