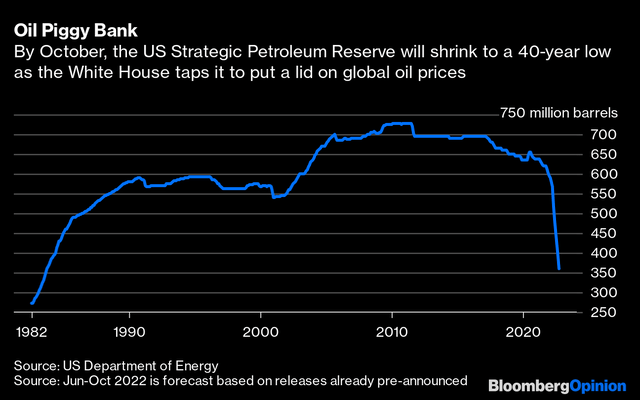

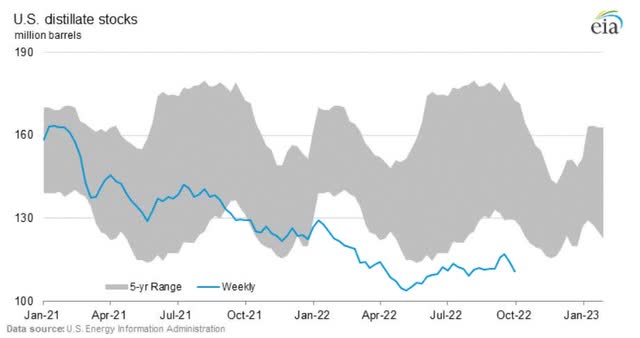

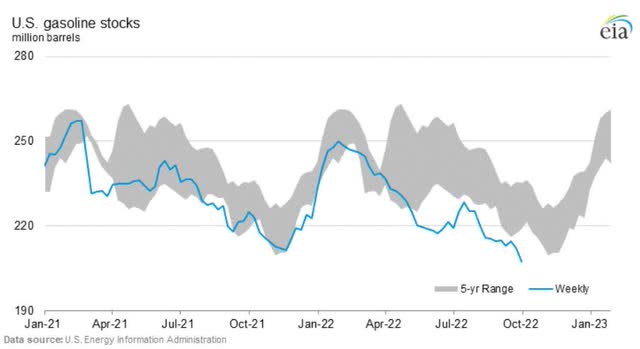

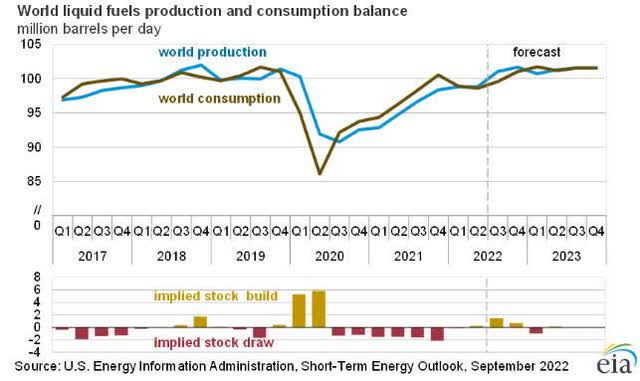

While supply has been cut, demand is still very strong as demand destruction has not materialized yet. The EIA reports that stock levels for distillates and gasoline are still at multi year lows.

The EIA estimates that the oil market will go into deficit by Q1 2023. As demand is strong and supply is declining, the oil price will move higher.

To ride this oil wave higher, we take a look at Tenth Avenue Petroleum Corp. (TPC:CA).

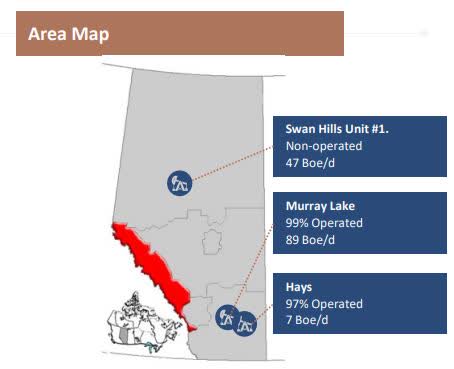

The company owns oil and gas assets in North America and is currently focusing on the Swan Hills, Murray Lake and Hays projects where a very successful drilling program with large upside is ongoing. Swan Hills is a project operated in joint venture with Canadian Natural Resources, a multibillion dollar company. The Murray Lake project is operated by the company itself and is its flagship project. The Hays project is a smaller project but still worth mentioning. Just recently, the company acquired another project from Danzig Resources Ltd. which adds another 38 boe/d to the assets.

Shares outstanding are currently at only 40 million shares which gives this company a very tight structure. 20% of these shares is held by management, which has an excellent track record in growing previous companies. They managed to raise $3 million CAD in order to purchase the property from Avalon, the previous operator.

The current market cap of the company is at $11 million CAD with no debt and $1 million CAD cash on hand. Even though this is a junior, they actually managed to generate positive cashflow in the second quarter of 2022 with a netback per boe of around $60 CAD. Based on my estimates of $90/barrel oil, this company should exit 2022 with a runrate of $4 million CAD cashflow. By next year, that cashflow should rise to $8 million CAD with more growth to come. The company has a $17 million CAD tax pool in place which will benefit them for about 3 years.

Based on this outlook, the company is trading at close to 1 times future cashflow which makes this oil junior an absolute bargain.

On top of this growth trajectory, there are additional joker cards that add even more growth. First of all, with the acquisition of the property from Danzig Resources Ltd., they also bought a 35% stake in a gas well which has a potential to produce 700 boe/d of gas. The 35% stake would add an additional 250 boe/d production to the company. Second, the Swan Hills property is showing a decline in growth from the chart above, but the company actually thinks this could increase by using increased water flow injection. Last but not least, the entire infrastructure is already in place, which should decrease the cost per boe produced with each new well going in production.

To conclude, I wish to mention some caveats to this bullish thesis. The company is increasing water injections as part of its growth program. Similar projects have had problems with water coning due to too aggressive increases in water injection rates which lead to a fall in oil production. Other than production problems, the company could also face headwinds from the oil price due to a possible recession. I estimate that the company won't be able to turn a profit below $50/barrel. Last but not least, the company's reserve estimates are not that large spanning 5-8 years. Any drop in reserve estimates could hamper its future growth.

Geen opmerkingen:

Een reactie posten