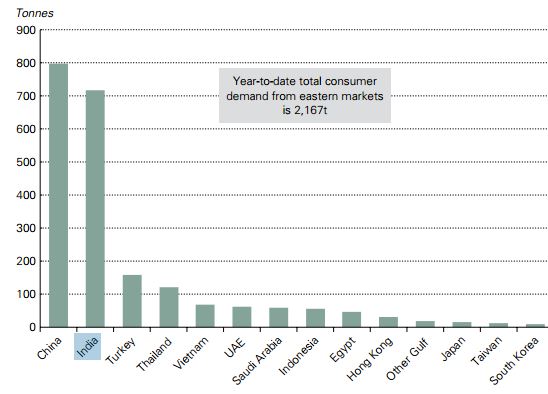

If you know that India is the second largest buyer of gold in the world, you would guess that India matters (Chart 1).

|

| Chart 1: Consumer Gold Demand per Country |

Now look at the premiums these Indians are paying for physical gold (Chart 2). The premium is currently 22%. So there is this disparity between the U.S. gold price (blue chart) and the Indian gold price (yellow chart). The question is: "Which one is most likely the equilibrium price?".

|

| Chart 2: Indian Gold Premium |

As we all know that India is a much larger player in the gold market than the U.S. (on the physical side), we should come to the conclusion that the Indian gold price is more likely to be the equilibrium. Indians will never stop buying gold. This implies that the gold price should already be at (1270+ (1270*22%)) = $1550/ounce instead of the current $1270/ounce.

Meanwhile, at Shanghai we see ever increasing silver premiums.

|

| Chart 3: Shanghai SGE silver premium |

Albert, I always find your blog very educational.

BeantwoordenVerwijderenI am interested in what you think of the following. It seems to me to be a big deal but nobody is commenting on it. Will it cause more bullion to come in to the market short term or will the increase in transparency show the weakness in the system? Thanks.

http://uk.reuters.com/article/2013/11/07/uk-lme-warehouses-idUKBRE9A611O20131107

I replied to your question in the next blog post. Thanks for bringing me into new ideas, I'm a bit out of ideas lately...

Verwijderen