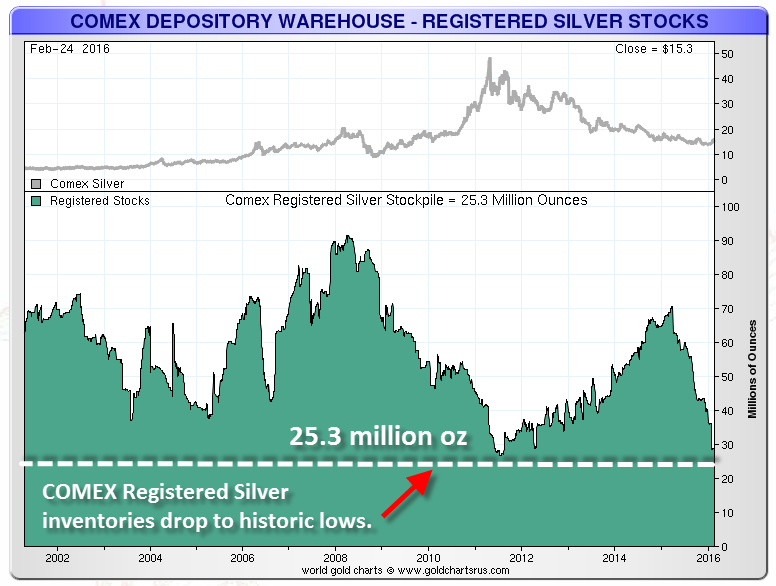

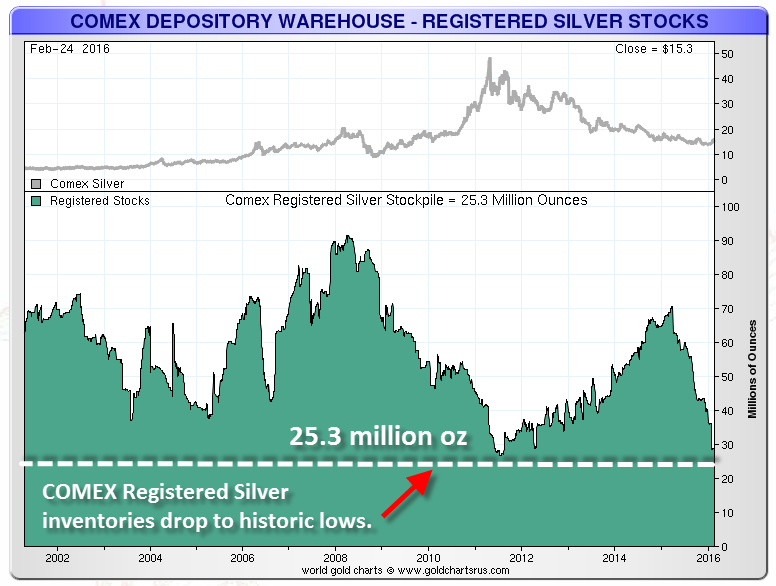

Something very interesting is happening in the COMEX silver space. Registered silver (blue chart) is rapidly closing in on zero and you would expect something to happen to the price of silver.

Just as registered gold has bottomed to zero, the gold price has also bottomed out.

Now when we look at the physically backed ETF's, we see it all happened this year. Funds were buying gold into the GLD trust again (red chart), which explains the small rise in registered COMEX gold inventories this year. We also saw a lot of COMEX volume at the start of this year. The gold price moved up this year.

But for silver nothing is happening at the SLV. Silver inventories (red chart) were flat.

Now coming back to the COMEX silver inventories. I find it very weird that the price of silver isn't moving at all, while inventories drop to historic lows and I have no idea why. Clearly, silver should be going up when you look at the negative correlation in this chart below.

Just as registered gold has bottomed to zero, the gold price has also bottomed out.

Now when we look at the physically backed ETF's, we see it all happened this year. Funds were buying gold into the GLD trust again (red chart), which explains the small rise in registered COMEX gold inventories this year. We also saw a lot of COMEX volume at the start of this year. The gold price moved up this year.

But for silver nothing is happening at the SLV. Silver inventories (red chart) were flat.

Now coming back to the COMEX silver inventories. I find it very weird that the price of silver isn't moving at all, while inventories drop to historic lows and I have no idea why. Clearly, silver should be going up when you look at the negative correlation in this chart below.

Geen opmerkingen:

Een reactie posten