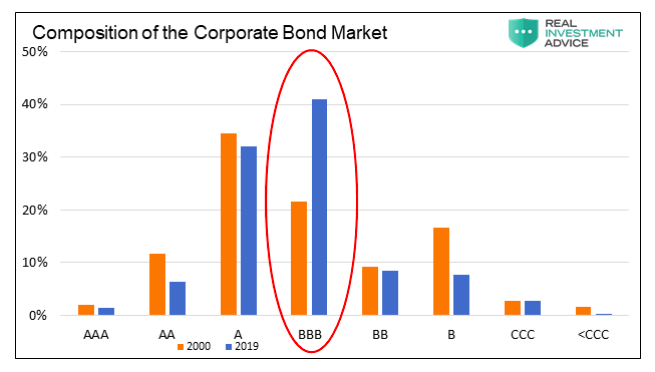

Remember that BBB corporate debt is now the major part of the bond market.

Even AAA bonds were sold off.

Something bad happened on 9 March 2020, where treasuries became illiquid.

Everything sold off including gold and TIPS to provide liquidity.

Might have something to do with the decline in the service sector's restaurant industry.

Gold is not being sold because of worsening fundamentals, but only to pay off debt at this point.

Gold demand is through the roof, many suppliers like Bullionstar can't keep up with the demand.

Geen opmerkingen:

Een reactie posten