How this all connects to the CFTC's LCNS numbers of July 2012, you can find out here.

- List of Correlations

- Gold Checklist

- Copper Checklist

- Gold Forecaster

- Oil Forecaster

- Stock Forecaster

- Bond Forecaster

- USD Forecaster

- Poo Forecaster

- Bitcoin Checklist

- Q Ratio

- Stock Valuation

- Leading/Coincident Indicator

- Misery Index

- Junk Bonds Vs. Stocks

- Currency Vs. Bonds

- Yield Curve Vs. Fed Funds Rate

- U.S. Bond Yields

- Dividend Yield Vs. Bond Yield

- QE Vs. Bond Yields

- Money Supply

- Dow Theory

- Excess Reserves

- Central Bank Balance Sheets

- Fed Balance Sheet Vs. Dow Jones

- Credit Spread Vs S&P

- Total credit Vs. Dow Jones

- Debt

- Debt Vs. Delinquency

- % Debt Held by Foreigners

- Interest Payment on Government Debt

- Disposable Income Vs. Housing

- Retail Sales Vs. Disposable Income

- Tax Revenue Vs. Stocks

- Tax Revenue Vs. Savings Rate

- NIIP Vs. Currency

- Trade Balance Vs. Currency

- Deficit

- Deficit to Outlay Ratio

- China Power Consumption Vs. China GDP

- Freight Vs. GDP

- Inventory Vs. GDP

- PCE Vs. GDP

- GDP Vs. Trade Balance

- GDP Vs. 10 Year Bond Yield

- GDP Vs. PMI

- Profits Vs. Employment

- Employment-Population Ratio Vs. Wages

- Employment-Population Ratio Vs. GDP per Capita

- Unemployment Vs. GDP

- Part-time Employment

- Productivity Vs. CPI

- Output Gap Vs. CPI

- Taylor Rule Rate Vs. Gold

- PPI/CPI/PCE

- Retail Sales Vs. CPI

- 2 Year Vs. LIBOR/SOFR Vs. Fed Funds Rate

- Loan Growth Vs. Fed Funds Rate

- Fed Funds Rate Vs. CPI

- Fed Funds Rate Vs. Unemployment

- Delinquencies Vs. Unemployment

- Delinquency Vs. Fed Funds Rate

- Labor Force Vs. Unemployment

- Non-Farm Payrolls Vs. Unemployment

- Quits Rate Vs. Wage Inflation

- Wage Inflation Vs. Unemployment

- Wage Inflation Vs. CPI

- M2 Vs. CPI

- Capacity Utilization Vs. CPI

- Capacity Utilization Vs. Unemployment

- New Homes Vs. Rents

- Lumber Vs. Housing

- Savings Vs. Housing

- Housing Starts Vs. Unemployment

- Initial Jobless Claims Vs. S&P

- Consumer Sentiment Vs. S&P

- Durable Goods Orders Vs. S&P

- Building Permit Vs. Housing

- Construction Vs. Housing

- Adjustable Mortgage Vs. Fed Funds Rate

- Fixed Mortgage Rates Vs. 30 Year Bond Yield

- MZM Vs. 10 Year Bond Yield

- Gold Vs. 10 Year Bond Yield

- Dow/Gold Ratio

- GOFO Vs. Gold

- Gold/Silver COMEX

donderdag 9 augustus 2012

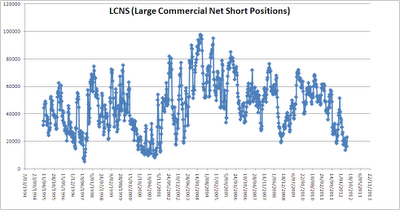

Update on Silver Net Short Positions: LCNS

On Monday 6th of August, the Financial Times leaked the news that the silver manipulation probe is likely to be dropped by the CFTC. It turned out that this news was premature. One of the 5 CFTC commissioners, Bart Chilton, said on 08 August 2012 that the investigation will continue as silver manipulation did occur. The silver manipulation probe was initiated in 2008 following a number of allegation of silver manipulation. Bart Chilton already found evidence of silver manipulation in 2010 and intends to search for additional evidence of this manipulation of the silver price.

How this all connects to the CFTC's LCNS numbers of July 2012, you can find out here.

How this all connects to the CFTC's LCNS numbers of July 2012, you can find out here.

Abonneren op:

Reacties posten (Atom)

The idea that the silver price has been manipulated is a fringe theory. It is much more likely that silver producers went short on silver when the price was high in order to benefit from high prices, and to protect the value of future production from price falls.

BeantwoordenVerwijderenI disagree with your hypothesis that silver is going to break out of its current trading range ($27-$28oz) because there is no hard evidence to suggest that will be at $US 40/ounce at the end of this year.

On the contrary, the forward price quoted today by CME

for silver in December 2012 is $28.125 and $27.995 for December 2013. If a breakout is going to occur, I would expect the future price to be curve to be slopping upwards, not downwards, comapred with today's price ($27.88).

If the price of silver is going to increase, it will do so if the Chinese government announces a new fiscal stimulus package. If that happens, then the price of silver will increase on the expectation that industrial demand for the metal will pick up.

Can't the forward price change in time? Is this backwardation and contango you are mentioning? I think backwardation is bullish for silver.

BeantwoordenVerwijderenAccording to: http://harveyorgan.blogspot.be/2012_02_26_archive.html

Net short positions by producers, users,... is: 50000.

Indeed producers are much more short than commercial traders. But the short positions haven't increased since 2008, they were constant.

I agree China is a contributor to silver price increase.

I agree, the forward price can change just as quickly as today's spot price. It is interesting how the most widely held Silver future contracts dated December 2013 are split into two camps: Buy at $50 and sell at $20, so maybe there is some evidence that silver will move much higher in the future.

BeantwoordenVerwijderenHowever, weak industrial demand, and the absence of any announcement for additional fiscal or monetary stimulus programmes suggest that the price of silver will trade between $27 and $28 for the time being.