So not only the Germans will get all of their 3400 tonnes of gold back, now the Swiss repatriation is almost reality.

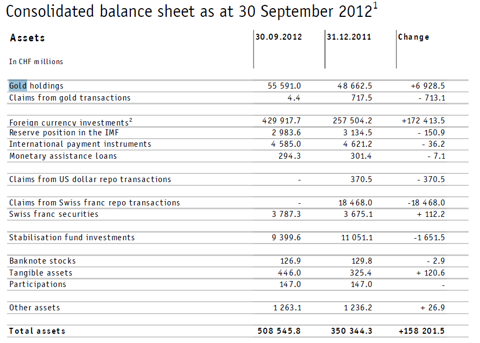

As of September 2012, the SNB had 55591 million CHF gold (Table 1). That's 59139 million USD gold or 33.4 million ounces of gold or 1040 tonnes of gold. That's one third of Germany's gold and is pretty significant.

Other countries who repatriated their gold are: Ecuador (26 tonnes), The Netherlands (613 tonnes).

The SNB hasn't said where its gold is and also hasn't said if it will repatriate their gold all at once, but if they were to repatriate the gold after a positive referendum, we would be witnessing almost double the amount of the gold that Germany wants to repatriate over 7 years: namely 674 tonnes of gold.

The referendum includes 3 items:

1) The Swiss National Bank should repatriate all of its gold to Switzerland

2) The Swiss National Bank cannot sell its gold

3) The Swiss National Bank should have at least 1/5 of its assets in gold

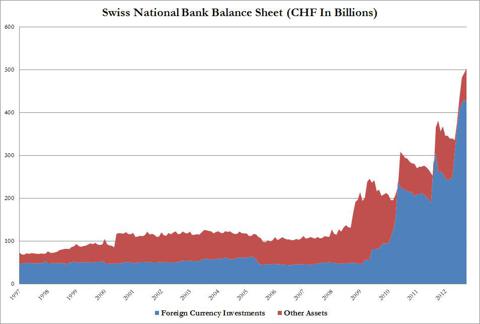

If this referendum takes place I believe the SNB will sell its excess in euros and European bonds and they will buy gold with it. This will make gold go up in euro terms. Investors can bet on this trade by selling euros and buying gold.

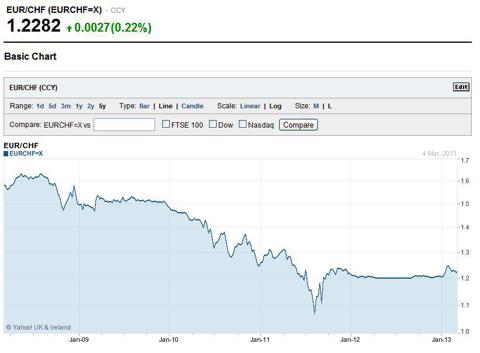

Since a year now, the SNB has pegged its currency against the euro (Chart 1) and has expanded its reserves in euros.

The conclusion is that this will be one of those very bullish events for the price of gold, if it really takes place (because we really aren't sure the referendum will come). We are talking about 1040 tonnes. Together with the German repatriation of 674 tonnes of their gold, we have almost 5% of the world's central bank gold reserves that will be repatriated. This is a significant number and it can spur an avalanche of further repatriations of gold. I also believe this will eventually lead to a rise in gold lease rates as central banks will want their leased gold back.

The key members of the Swiss Gold Initiative can be witnessed below:

Is copper being hoarded?

BeantwoordenVerwijderenhttp://www.bloomberg.com/news/2013-02-25/copper-stockpile-near-16-month-high-on-storage-incentive-supply.html

http://online.wsj.com/article/SB10000872396390443779404577643930176911276.html

There hasn't been a lot of demand from the Chinese in February. That gives oversupply.

Verwijderen